Sourcing and Procurement

Crude Oil – the Global Market Snapshot

Crude oil prices remained volatile during most of 2019 as a result of prolonged geopolitical tension in the Middle-Eastern region and overall economic slowdown in all major economies. Currently, the decline in demand for crude oil from China, due to the outbreak of coronavirus, is the key factor dragging down the prices.

However, the demand boost for Ultra-Low Sulphur Diesel (ULSD) in the first half of 2020 from Marine industry is expected to increase the prices of crude oil, even as oil refineries ramp up output to meet the demand for new fuels from the marine industry, after the implementation of International Maritime Organization (IMO) 2020.

Factors affecting crude oil prices, supply and demand in 2019-2020*

- During Jan-2020, the crude oil market remained oversupplied, mainly due to a decline in demand for crude oil by 20% from China, as a result of the outbreak of coronavirus. As per Energy Information Administration (EIA), the global demand for petroleum and liquid fuels will average at 100.3 million barrels/day in the first quarter of 2020, which is 0.9 million barrels/day lower than January Short Term Energy Outlook (STEO).

- As an effective response to keep crude oil prices from plummeting further, Saudi Arabia and its crude oil-producing ally countries are expected to reduce production further by 600,000 barrels/day.

- During H1 2019, the supply of crude oil exceeded demand by 0.9 million barrels/day, and it remained oversupplied in H2 2019, due to sluggish industrial demand globally.

- As per ISM’s PMI index, US manufacturing activity has dropped to its lowest level in the last 10 years (47.8 in December 2019, from 48.1 in November 2019).

- Germany’s economic output fell by 0.1% in April-June, while July-Sept growth is also expected to remain negative.

- British Chambers of Commerce, Brexit uncertainty, coupled with US-China trade war, has led to a decline in UK’s business investment (expected to decline by 1.5% in 2019 and 0.1% in 2020).

- However, numerous events in recent times have also resulted in supply-side disruptions that have led to volatile fluctuations in crude oil prices.

- For instance, a drone attack on Saudi’s Aramco oil processing facilities on 14th Sept 2019 resulted in 5% reduction in global oil supply, that led to ~15% increase in crude oil prices to US$69. However, crude oil prices reverted to pre-attack levels during the first half of October, 2019.

- On October 11, a missile attack on an Iranian oil tanker created a fresh potential for supply disruption of crude oil, and as a result, Brent crude oil price increased by around 2.4%, to US$ 60.51 per barrel.

- On 3rd January, 2020, crude oil prices have risen sharply (brent crude jumped by more than 3% and reached US$69.5 per barrel) after the killing of the Iranian general Qasem Soleimani in a drone strike.

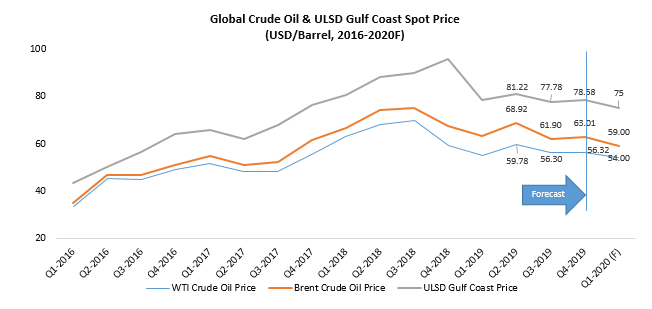

Price Outlook (Crude oil)

- The brent oil spot price is expected to be around US$56-US$60/barrel during first half of 2020, and US$62-US$66/barrel during second half of 2020. West Texas Intermediate (WTI) crude oil will average around US$5.5/barrel, lower than the brent oil spot price during the same period.

- Although the market is fundamentally oversupplied, the IMO’s requirement of low-sulphur fuel is expected to increase the crude oil demand, as refineries would need more oil to produce low-sulphur oil. However, a downgrade in oil demand outlook indicates that there will be lower quarter-on-quarter increase in oil prices in 2020.

Price Outlook (ULSD)

- Despite the weak demand from the manufacturing sector globally, the demand for ULSD is expected to rise in 2020, due to implementation of IMO in 2020. The marine sector will have to reduce sulphur emissions by ~80% by switching to lower sulphur fuels. The maximum fuel oil sulphur limit will fall to 0.5 wt% from 3.5 wt%

- Due to the increase in demand of low sulphur distillate oils, prices of ULSD is expected to increase by 15-20% by 2021

Directly Impacted Industries

1. Freight & Shipping:

Fuel cost represents 50%-60% of the total operating costs for the freight and shipping industry. As a result, change in crude oil prices could result in 9%-12% rise in road freight charges or significantly impact bottom lines of transportation industry, if they plan to absorb the price fluctuations.2. Lubricants:

Mineral-based base oil is the primary cost component for lubricant manufacturing and it is produced by distilling crude oil. So, any change in crude oil price would significantly impact the price of lubricants.

Indirectly Impacted Industries

1. Tyres:

Crude oil derivatives used in the manufacturing of tyres represents 30% (synthetic rubber, carbon black, etc.) of the total raw material cost. A rise in crude oil prices would significantly impact the tyre manufacturing industry. However, the impact of rising crude oil prices is partially offset due to decrease in input cost for carbon black, owing to oversupply of high sulphur fuel oil (HFSO), after the implementation of IMO 2020.2. Mining:

Freight costs, as well as mining diesel costs, stand to increase overall delivery and operating costs for the mining sector.3. Cement:

Energy costs being one of the key components for cement manufacturing, increase in fuel costs will negatively impact the cement manufacturing sector.4. Infrastructure:

Infrastructure projects include products that use heavy sulphurous oils as input (naphtha, asphalt). However, the rise in crude oil prices will be partially offset for the industry due to oversupply of high sulphur fuel oil.