The New Disruption Playbook Play 1 of 7: Your strategy, business profile and relationships will determine the best plays to make

The global business landscape has entered a new era—one defined not by stability, but by constant disruption. From shifting trade policies and tariffs to geopolitical tensions, climate volatility, and supply chain shocks, uncertainty is no longer the exception—it’s the rule. In this environment, companies must rethink not only how they operate, but how they prepare to compete in a world where the rules can change overnight.

Tariffs are one example of how external forces can upend established supply chains and reset the competitive playing field. But they’re not alone. The cumulative effect of these disruptions demands a new kind of readiness that blends agility with foresight. You may not need to throw a “Hail Mary” just yet, but there’s never been a more important time to have a playbook that helps you assess vulnerabilities, identify strategic pivots, and build the resilience needed to absorb future shocks.

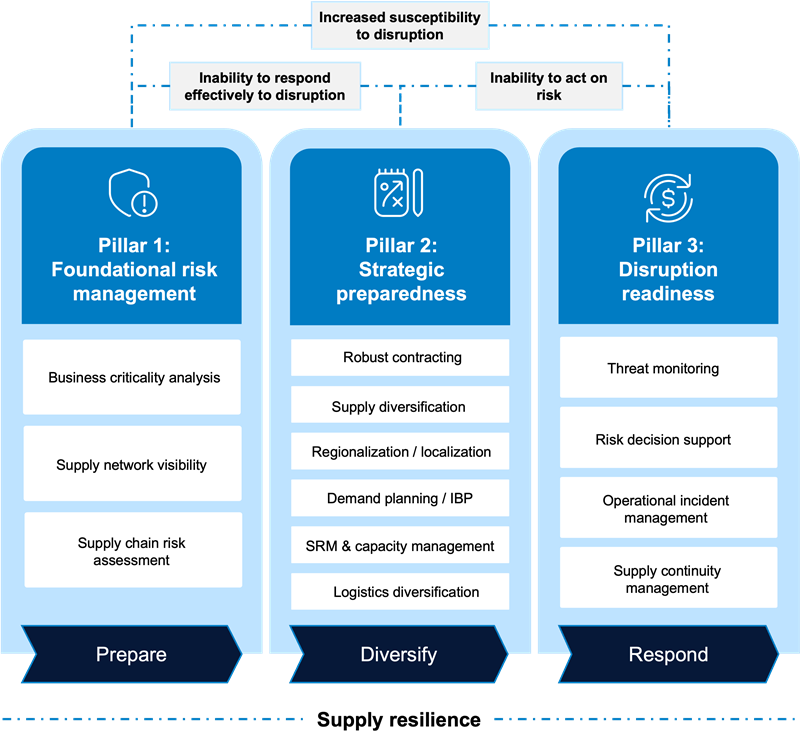

This seven-part playbook explores the plays you might consider. But before diving into tactics, there’s a more fundamental question: “Are you match fit—and is your supply chain ready for the game ahead?” To answer this, think through the three pillars of fitness that you should have before you run out onto the field.

Pillar 1, foundational: You must have visibility of your supply chain beyond the first tier of suppliers. You also need to understand international logistics. Next is the ability to model the landed cost of goods and, ideally, develop a more complete “should cost” model. Other foundational capabilities include risk analysis by segments and suppliers, as well as general market intelligence.

Pillar 2, strategic preparedness: Can you go the distance? This capability means your suppliers have ample capacity to meet contract requirements and that procurement expertise is integrated into your supply chain design.

Pillar 3, disruption readiness: Play offensively. You must be in control of securing and monitoring supplier capacities, ensuring management tools are available, and that your suppliers recognize that adaptation will be a feature of your relationships. This is to protect trade, predicting and preparing responses to new conditions.

Infosys Portland supply resilience framework

The three capability pillars will help you to make any of the plays you think make sense for the game your company will play. So, let’s now look at what those possible plays might be.

play 1: optimization and diversification

The recent surge in reactive supply chain responses – inventory swings, warehousing strains, and logistics congestion – has highlighted a deeper issue: Resilience hasn’t been designed into many supply chains. These aren’t failures of just-in-time models; they’re the result of engineering to plan without building flexibility and foresight into the system from the outset.

Diversification is often cited as the answer, but it assumes you know your options. The first step is to map the terrain. That means building a multi-tiered view of your supply network, extending beyond tier-one suppliers. Overlay this with known and potential tariff exposures: Where they are, who they affect, and what alternatives exist. Unfortunately, it is true that many organizations discover they lack visibility beyond their immediate suppliers. Ideally, you should be collaborating with essential internal and external stakeholders from the start. Nonetheless it is now critically important you collaborate now.

The bullwhip effect, being felt by carriers, ports, and warehousing providers, is a clear signal that supply chains are absorbing shocks they weren’t designed to handle. To move beyond reaction, we must embed resilience into the architecture itself. That means designing for optionality, not just efficiency. It means accounting for cost and capacity impacts across the entire network, from bonded warehousing to supplier agility and to freight routing.

Foreign trade zones (FTZs) and bonded warehousing offer tariff time-outs that allow goods to be stored, processed, or manufactured without immediate tariff application. Over 200 FTZs in the U.S. alone – many near major ports of entry – provide a strategic buffer, especially when re-exporting goods or managing tariff timing. Embedding specialist trade advice into your supply chain design, via your supply chain partners, could also be one of your strategies.

Just as quarterbacks study route patterns, supply chain leaders must understand these redesigned logistics pathways. Different combinations of suppliers, allocation decisions and inventory holding choices may come with vastly different cost and supply chain service implications. Fortunately, state-of-the-art tools – increasingly powered by AI – and demand driven methodologies now make it possible to optimize the use of these alternatives with greater precision.

As organizations consider near-shore and on-shore sourcing to build resilience, a new challenge is emerging, capacity constraints. The assumption that alternative suppliers and logistics networks can absorb sudden surges in demand is proving optimistic. In reality, many of these options lack the embedded capacity, infrastructure, or readiness to scale at the pace required. This is where sourcing new suppliers must go beyond theoretical modeling. Companies need to incorporate capacity assessments, supplier readiness evaluations, and logistics throughput analysis. Procurement can play a key role here in bringing commercial acumen to assess not just cost, but capability and scalability too.

what can procurement do?

Procurement can offer the following expertise:

- Validate design choices to ensure that the supply chain design is not only theoretically sound but commercially viable.

- Embed trade and tariff intelligence into the design process.

- Guide selection of supply chain partners by bringing commercial negotiation and relationship management expertise to strategic decision making.

- Own landed cost modeling and “should cost” analysis to enhance sourcing and supply chain strategies.

- Support supply chain scenario planning that simulates the impact of disruptions, tariffs, or demand changes on total cost and service.

- Support supply chain governance and execution discipline ensuring the transition from design to execution.

Remember, resilience isn’t just a pivot. It’s a principle. And the expertise outlined above embraces that principle.

a real play: a US manufacturer

This US client manufactures, markets, and designs innovative food and beverage container solutions, with major consumer brands sold globally. The brief was to assess options to diversify or nearshore stainless steel manufacturing to 3 or 4 global sites.

Firstly, we confirmed the capabilities of potential manufacturers against detailed specifications for the grade of steel needed. Next, we assessed the cost impact of changing suppliers and locations. Then we clarified the timescales for nearshoring to key markets.

Implications of steel trade protections in various markets and unit prices and the viability of supply markets for various importing markets were considered. From a pool of 86 potential suppliers, a short list of eight manufacturers were assessed in detail. We identified two options for immediate supply base diversifications. Our assessment identified up to 26% cost savings compared to the current state. Moreover, we developed IP that could be leveraged by other product lines.

We hope this first play helps you think through possible options or gets you on the path of useful research.

The second play in the New Disruption Playbook series looks at how you can use collaboration and strategic information management to your advantage in this new environment.

The New Disruption Playbook Series:

Play 1 on Diversification

Play 2 on Collaboration

Play 3 on Contracts

Play 4 on Innovation

Play 5 on Sourcing

Play 6 on Capacity

Play 7 on Freight Procurement