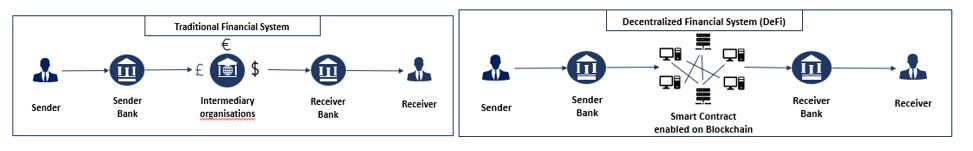

With rapid technological advancements transforming the financial services industry, one major trend observed is the shift from centralised systems to distributed architectures. A decentralised blockchain-enabled public network offering financial services and products represents such an alternative financial system known as Decentralised Finance or DeFi. In traditional financial systems, banks or financial institutions provide services such as liquidity, asset management, and underwriting; however, in DeFi, a code-based agreement known as a 'Smart Contract' governs financial systems and processes without the need for human intervention. Even though the adoption of DeFi is still in a nascent stage, it is expanding quickly across the globe. In April 2022, the total digital assets value in DeFi services surpassed $ 230 B, having grown from less than $ 1 B in 2019 to over $ 15 B by the end of 2020.

Use cases

DeFi has created a plethora of new opportunities and activities for individuals worldwide. DeFi is much more than just a nascent ecosystem of new opportunities; it's a massive and well-coordinated endeavour to develop an alternative financial system that can rival a centralised financial system in terms of accessibility, and transparency. Many of the services provided by DeFi protocols are currently replications of existing financial services, such as lending and borrowing, trading, insuring, pricing digital assets, etc.

- Asset management

- Compliance and KYT

- Derivatives

- Digital identity

- Insurance

- Lending and borrowing

- Exchange

- Payment

Powered by smart contracts, DeFi protocols create a portfolio of digital assets by collecting individual digital assets backed by traditional assets such as real estate, which in turn ensure greater transparency and efficiency.

Conventional banking systems emphasise Know-Your-Customer (KYC) rules to comply with anti-money laundering (AML) and counter-terrorist financing (CFT) regulations. DeFi rectifies this by utilising digital addresses and transaction behaviours in place of user identities as part of the Know-Your-Transaction (KYT) approach in a decentralised architecture.

DeFi helps connect derivative purchasers and suppliers without any counterparty. Smart contracts create derivative assets based on any tokenised underlying asset such as futures, options etc.

Conventional financial organisation mandates screening for all participants to avail of products and services. This limits the inclusiveness of the traditional financial ecosystem. DeFi enables everyone to participate in the financial ecosystem by relying on pseudonymous identities without having to worry about discrimination against their identity.

In the blockchain-based DeFi ecosystem, customers can buy insurance to protect against losses of digitally backed assets. Without using a typical insurance broker, a DeFi platform connects people looking for coverage with people willing to insure them in return for premium payments.

DeFi uses a collection of funds enabled by a smart contract known as a "Liquidity Pool" to facilitate peer-to-peer lending and borrowing in an automated and permissionless manner.

Customers can trade their cryptocurrencies on DeFi-enabled exchanges without requiring an exchange operator, identity verification, or other requirements. Rather, the smart contracts manage security, carry out trades, and oversee the exchange rules using market marker protocols. DeFi-enabled exchanges, in contrast to centralised exchanges, frequently do not necessitate the deposit of funds into an exchange account before executing a trade, thereby mitigating the significant risk of exchange hacking.

DeFi facilitates the utilisation of digital assets for purchasing any products and services without the need for an intermediary. It also permits the transformation of digital assets owned by the buyer into digital assets that the seller accepts.

Advantages of using DeFi

Retail and institutional players have distinctive opportunities to unbundle the conventional financial ecosystem, with enhanced control and transformational opportunity to customise products and services, due to the decentralised peer-to-peer DeFi ecosystem.

With the increasing adoption of DeFi solutions, institutions have the chance to take advantage of DeFi’s numerous unique qualities.

- Transparency - DeFi’s decentralised ecosystem ensures transparency by keeping the underlying blockchain structure public whereas the private wallets offer customers full control of their assets through privately held “keys.”

- Quicker settlement - With the use of blockchain technology, "instant" real-time settlement is possible, potentially eliminating settlement wait times.

- Increased liquidity – DeFi has the potential to boost financial inclusion by giving unrestricted and borderless access to products and services to anyone with internet connectivity, thus reaching a sizable portion of the underbanked or unbanked customer base.

- Enhanced control - Digital assets are kept in self-hosted or un-hosted wallets giving users more control over their assets thus providing greater autonomy and the option to interact directly with a digital currency structure.

- Decreased transaction cost - The participants' transaction costs may be decreased by the streamlined interaction model between the participants (such as a lender and a borrower), which is governed by the core protocols in smart contracts.

- Process simplification – Eliminating the need for intermediaries, which upholds the confidence between the parties in any financial transaction, DeFi enables direct transaction settlement between the participants and thereby enhances the efficiency of financial processes by streamlining operations.

Potential risks and challenges

The decentralised nature of the DeFi results in certain vulnerability to risks and challenges which are usually mitigated by a central intermediary in a conventional financial system. Additional worries about consumer protection and AML risks also occur due to the decentralised structure of DeFi services and the lack of regulations. Several other challenges to think about are:

- Security vulnerability owing to complexity and immaturity

- High volatility of digital assets

- DeFi application governance mechanism

- Limited and inconsistent liquidity

- Regulatory uncertainty due to lack of current regulation

- Over-dependence and over-reliance on digital platforms

The rapid growth of the DeFi has been driven by a range of macroeconomic and technical trends over these past years. DeFi is adapting rapidly intending to replicate the traditional banking ecosystem. In the future, this new form of decentralised financial ecosystem is likely to have an impact on the future of central banking entities and DeFi could be perceived as a low-cost, more efficient alternative than any other.