Digital Interactive Services

Dealing with the Mother of All Risks - Operational Risk

Research and development, marketing and sales, support functions, as well as corporate services, are a few of the primary pillars of any organization. All the pillars, along with the multiple sub-functions, must perform smoothly for an organization to avoid potential operational risks.

It is evident that all business risks ultimately arise from operational deviations or operational wrongdoings. Hence, there is a strong need to build an actionable and rational framework, keeping the operational risk at the heart of risk management.

The existing risk management framework at play, however, is designed as a “Costly Diagnostic” method, which includes a slew of activities, including identifying, measuring, managing, monitoring, and reporting, to scan the entire organization’s landscape. Simply put, the existing framework doesn’t provide a structure or foundation for companies to build an actionable risk management strategy.

Operational risks are generally within the control of the organization through effective risk assessment and risk management practices. However, organizations fall behind in managing it due to unclear structures or weak foundation of existing risk management frameworks.

Overlooking this need could have adverse impact on businesses, leading to loss of customers, loss of business value of a product or a service, and can also impact a company’s bottom line. Operational risks can range from losing a few dollars due to minor human errors, or even bankruptcy, due to serious operational frauds.

Types of risks associated with operations are:

-

Business interruption

-

Product failure

-

Health and safety

-

Failure of IT systems

-

Loss of key people

-

Litigation

-

Loss of suppliers, etc.

Method to Follow

Risk evaluation is carried out to make identify the impact of vulnerable operations on an organization, and to determine which risks are to be treated. When looking at operational risk management, it is important to align it with the organization’s risk appetite, which is often influenced by the size and type of organization, capacity for risk, the ability to exploit opportunities, and withstand setbacks.

Any deviation from set protocols at the operation level can lead to potential risks. Risk experts, or the existing risk frameworks, however, rarely base their findings on the study of risk management. Organizations do realize the importance of risk management, but the implementation often lacks method.

In today’s complex economy, the financial industry plays a significant role in the functioning of governments and businesses. The financial industry performs an enormous number of activities, from simple to complex, and any misstep could harm companies.

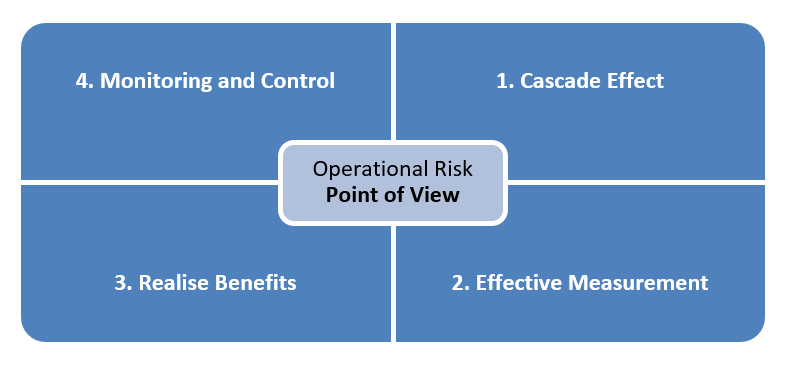

Refer to the below proposed actionable method to address the issues:

Cascade Effect:

Understanding risk psychology is important to identify and assess possible risk events within a business value delivery framework. The cascade effect theory will help to perform an in-depth impact analysis. However, choosing or establishing the right scale or right starting point is the challenge. Hence, keeping operational risks at the heart of risk management frameworks is crucial and imperative to implement the cascade effect. Once risk practice configures where and what the risks are, the next step is to measure the impact.

Effective Measurement:

The second step is to quantify the impact. This step allows risk practices to build an algorithm for measuring the impact and converting it into numbers for effective communication across the organization. Effective measurement enables risk practices to communicate, prioritize, and include a risk culture across teams, while risk management becomes a part of core operations.

Realize Benefits:

A good risk management practice will identify where, what, and how a possible risk might occur and impact businesses. It provides a dynamic roadmap to execute an effective strategy to deal with it in advance, both for short- and long-term gains.

Monitoring and Control:

Finally, a comprehensive framework and the actionable methods therein, must have an effective monitoring and control mechanism that gives visibility of what is happening and how to control deviations.

Having a cost-effective and actionable risk management framework, which will cut down on expenses on resources, will diminish financial losses and help retain customers. In simple terms, a robust operational risk management framework adds strength to an organizations ability to imagine a sustainable future.