Finance and Accounting

Two Use Cases in Blockchain-Based Finance Transformation

Financial transactions and binding contracts form the crux of global economic and legal systems. They are used for compliance and reporting of the growth data of organizations of all sizes. Recording financial transactions are the core of business operations.

Blockchain is a transformative technology that will bring high level of transparency, security, and efficiency to the finance function. Being an open and distributed edger, it provides efficient and verifiable bookkeeping. In this article, you will get an idea of two specific blockchain use cases in finance.

On October 30, 2020, Infosys BPM conducted a webinar titled “Powering the Future of Finance Through Blockchain”. This webinar saw Infosys BPM’s leaders, Vinay Gopal Rao, VP & Strategic Business Practice Head - F&A and Sandeep Sahadevan, Sr. Domain Principal, Head- Key Solutions & Alliances, FCoE, joined by Shirly Hung from Everest Group. The webinar was moderated by Chaitra Nayak, Head – Analyst Relations. Sandeep takes a close look at the following two key use cases of blockchain in finance.

Use Case 1. Letters of Credit

While Infosys has multiple use cases in Blockchain across Trade Finance, we wanted to focus on one specific use case on Letters of Credit (LC)

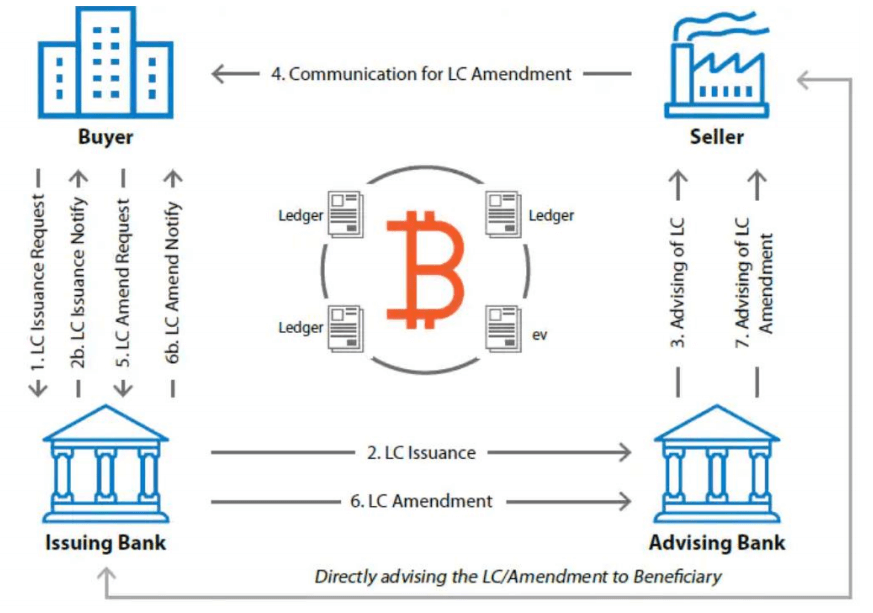

LC is a letter from a bank guaranteeing that a buyer's payment to a seller will be received on time and for the correct amount. Typically, the process begins when the seller requests a letter of credit from the buyer. The buyer arranges this through a bank (issuing Bank), which is then issued to the seller through their bank (advising bank). The LC is settled once the transaction is completed, ensuring the payment is made to terms.

There are certain issues with this process; for instance, it’s a siloed transaction among the involved parties. There are individual, isolated transactions among the buyer, seller, and their respective banks. This intricate chain of transactions gives rise to some complexities, such as the following.

High costs:

Transactions in LC involve unnecessary costs. OECD (Organization for Economic Cooperation and Development) has identified that hidden costs arising from excessive documentation and manual processes constitute up to 15% of the value of traded goodsUnusual delays:

It usually takes from a week to over 10 days for transactions to be completed.Lack of Authenticity:

Since the entire process involves physical documents going among different parties, authenticity comes into question multiple times.Zero Visibility:

Since there are multiple isolated processes, gaining visibility into activities at any point in time can be difficult.

The Solution: Infosys Finacle Trade Connect

Infosys Finacle Trade Connect is a blockchain-based solution developed to digitize and automate inter-organization trade finance process on a unified distributed, trusted, and shared network. The solution helps banks curate trade networks with their corporate customers, frequent trade partners and other stakeholders, driving drastic reduction in cycle time, unprecedented efficiencies and customer value.

In order to automate inter-org trade finance activities, Trade Connect solution brings together banks, companies, and trading partners (including shipping companies, insurers, and customs agencies) into a unified, distributed network as shown below.

Letters of credit is not the only use case of Trade Connect. Others include bills of exchange, supplier financing, etc.

Trade Connect was formed as a consortium of seven banks in May 2018, with Infosys playing the role of the technology partner. It is a cloud-hosted, API-driven distributed ledger system. The advantage of this platform is that the users (banks, companies, and trade partners) do not have to undergo any major changes in their banking systems in order to take advantage of it.

In the two years since its inception, Trade Connect has been a runaway success. Today, the number of banks participating in the network has grown to 15.

The key benefits of Trade Connect are below.

Augmentation:

Ability to bring the benefits of blockchain to the banking systems without having to rip and replace everything, since the platform is API-driven.Operational efficiency:

The normal, 9-day LC process has come down to two days. This represents nearly 80 percent improvement in operational efficiency.Cost:

Besides the huge documentation costs involved in LC processes, banks also incurred costs due to the usage of the SWIFT (Society for Worldwide Interbank Financial Telecommunication) network. With Trade Connect, these costs are eliminated fully.Authenticity:

The trade finance data is completely visible to all the transacting parties. This drastically reduces the probability of fraud.Visibility:

Since the data on the blockchain is visible to all the participants, the issue of isolated transactions and lack of visibility is eliminated.

This solution aims at handling over 85% of the domestic letters of credit. In addition to the banks, Trade Connect will include non-banking participants such as shipping companies, customs department, and governments. Besides, Trade Connect will transform the business ecosystem with smart contracts.

Use Case 2. Intercompany Transactions

A study has revealed that about 30% of global trade is constituted by intercompany (IC) transactions, IC transactions, are highly regulated and non-compliance has large regulatory consequences. In many cases, the heterogeneity of systems within different units of an enterprise adds to complexity thereby requiring a lot of effort to record and reconcile.

Infosys BPM aims at improving the intercompany process for the enterprise, leveraging blockchain. Our private permissioned blockchain for Intercompany targets multinational corporations with a complex, heterogeneous ERP landscape. Key advantages of this holistic framework for intercompany transactions include the following.

- Smart replication: Intercompany transactions can be initiated in any ERP system. The underlying API-based blockchain replicates the transactions. This is possible in reverse as well, where the transactions are initiated in the blockchain and replicated in the ERP.

- Intercompany reconciliation: Blockchain allows for seamless reconciliation of data, such as purchase and sales ledgers.

- Net settlement: In the geographies where it is possible, the intercompany blockchain can help with net settlement.

Conclusion

As you can see, the impact of blockchain is far-reaching. It’s poised to become a game changer in the world of business, much like the internet or cloud computing themselves. Going forward, it’s possible to discover even more transformative use cases for the blockchain technology.