The wave of digitalization is becoming a key factor in tax regulation changes worldwide. A range of digital tax reporting obligations have been introduced globally, mainly with the intention of decreasing tax fraud. This issue is especially significant for VAT, considering the substantial VAT gap that continues to exist in a number of countries. In this article, we'll deep dive into one of the most prominent tax trends: structured e-invoicing, which is quickly becoming popular all over the world.

Structured e-invoicing concept – what will change?

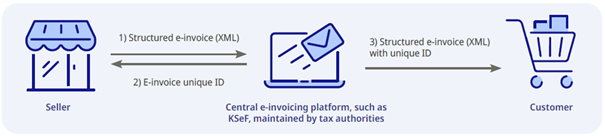

Under the present model, tax authorities typically obtain information about specific transactions only after invoices have been circulated between the two parties involved, that is, the seller and the buyer. This is often done through the periodic reporting of SAF-T (Standard Audit File for Tax) files, if such type of reporting is in place in a particular country. Invoices are usually in the form of a PDF and are shared between the transaction participants, often via email.

However, the adoption of structured e-invoicing proposes a change to this workflow. With this method, invoices are initially sent to tax authorities for clearance before they are forwarded to the buyer. As a result, tax authorities receive real-time data about taxpayers' transactions and effectively become a participant in the invoicing process itself.

The key change is the new format for e-invoicing, which is called “structured”. The most common format for structured e-invoicing is XML, which holds data in a clear, ordered way. It’s important to note that using structured e-invoicing means all taxpayers have to create invoices in the exact same format. However, even though XML works great for computer processing, it’s not easy for people to read.

The impact of structured e-invoicing on business processes and associated technologies

Structured e-invoicing, driven by shifts in tax regulations, triggers extensive changes within the finance and accounting areas. Implementing this system isn't merely about adopting a new tech solution; it also calls for a thorough transformation of existing business processes.

In the following section, we showcase a few examples, mainly based on the Polish structured e-invoicing model, Krajowy System e-Faktur (KSeF).

Accounts Receivable

- Invoices will have to be sent to tax authorities almost instantly;

- A detailed mapping process will be needed to convert data from ERP/billing systems to the XML scheme;

- Various concurrent invoice workflows will have to be established as not all customers, especially foreign ones, may be able to retrieve invoices from the central e-invoicing system. The visualized invoices sent to these customers will likely need to contain a special QR code.

Accounts Payable

- A major redesign of the Accounts Payable process is necessary to accommodate XML invoices, including considerations for tasks like PO matching, VAT coding, etc.

- Like Accounts Receivable, parallel workflows will need to be set up to handle invoices from vendors outside of the KSeF system, especially foreign ones.

Payment Process

- It's anticipated that a unique invoice ID (assigned by KSeF, different from the internal invoice number) will need to be included in the payment transfer title.

- This affects both outgoing and incoming payments, such as matching payments with invoices.

T&E (Travel and Expense) Process

- T&E invoices will show up along with all other invoices issued to a particular taxpayer in KSeF, impacting the process of linking a specific invoice to an individual employee. Typically, invoices currently move from an employee, through an approval process, to the accounting department.

VAT Reporting

- It may be necessary to include additional data in VAT reports, like the KSeF ID number;

- Additional reconciliation between VAT reports and KSeF data may be required.

It’s noteworthy that companies typically employ a range of tools, such as AP workflow solutions, to aid the processes affected by structured e-invoicing. Given the significant impact of this new invoicing approach, businesses must re-evaluate their toolset’s role and consider how to integrate these tools with their primary e-invoicing solutions. In some instances, it might be necessary to question the continued need for certain technologies. For instance, OCR technology, which was pivotal for traditional invoicing processes, may become obsolete as structured e-invoices are already configured in a format that is ready for digital processing.

The impact of structured e-invoicing on corporations operating with an outsourcing model

Many corporations today leverage outsourcing partners to sustain their business operations. They typically rely on BPO/BPM partners, their own SSC/GBS centers, or a combination of both. The complexity of implementing structured e-invoicing projects is heightened as these processes are often, to varying degrees, outsourced.

Ensuring a balanced distribution of tasks between the outsourcing partner and the business (outsourced versus retained) is critical for maintaining high-quality business processes. It is also vital to define responsibilities and accountabilities for individual processes with precision. In the light of structured e-invoicing, such agreements might need re-evaluation.

Inevitably, the introduction of structured e-invoicing will necessitate substantial revisions to Standard Operating Procedures (SOPs) to encompass changes brought about by process redesign. Furthermore, invoice processing in national central systems requires proper credentials, so the setup of roles in both the outsourcing partner and the organization needs careful thought, including the consideration of backup structures for process continuity assurance.

The upcoming expansion of structured e-invoicing

The initiatives for structured e-invoicing are primarily localized, and there's a noticeable lack of global harmonization at present. Current e-invoicing efforts are predominantly concerned with domestic dealings, with no global unified reporting method. Nonetheless, along with structured e-invoicing, there's an increasing trend of countries extending electronic reporting requirements to encompass invoices not covered by e-invoicing.

Even so, it's anticipated that a growing number of countries will adopt structured e-invoicing as their primary billing model. Despite differing timelines for implementation and country-specific variations, it's unequivocal that structured e-invoicing will profoundly influence businesses and act as a catalyst for financial transformation in the years ahead.

This article was first published on FOCUS On Business