STEP Platform

Overview

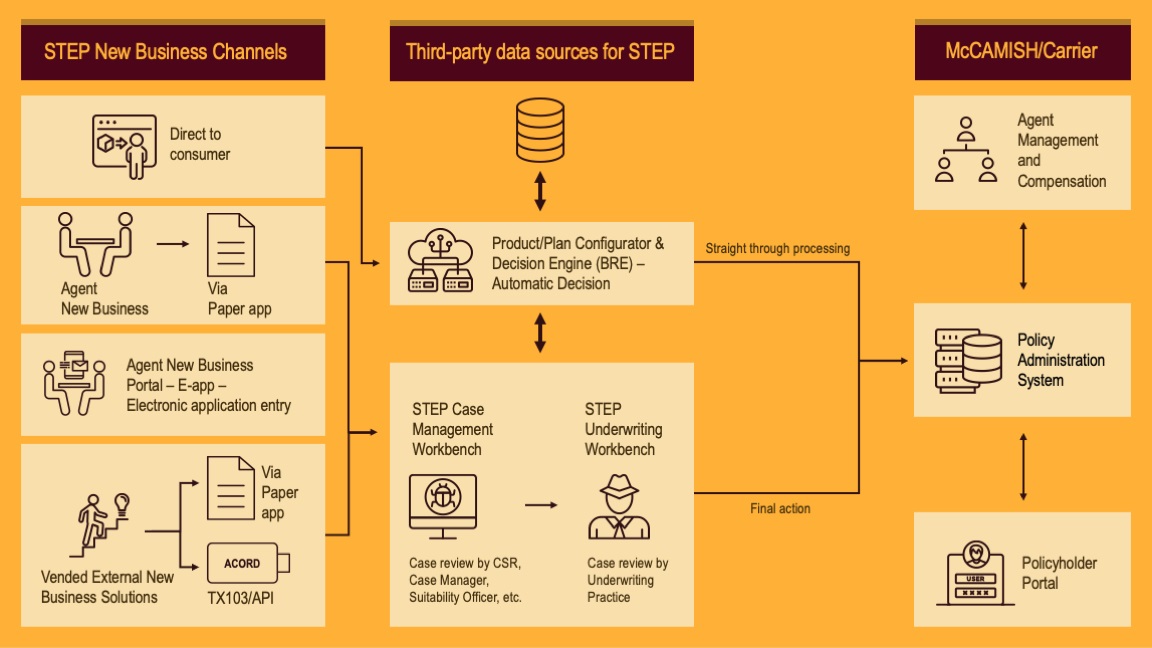

The STEP platform provides a straight-through solution for origination, underwriting, and issue of life insurance and annuity policies. The platform can quote and recommend products and suitable coverages based on the customer’s lifestyle, financial state, and unique requirements, and is a customizable, multi-product, new business and underwriting platform.

The platform is equipped with customizable digital e-solution portals for customers and agents who drive business through a personalized experience. The highly intuitive ‘Direct-to-Consumer’ and ‘e-app through agents’ channels offer new customers hassle-free and fast new business application process. The API-enabled case management and underwriting workbenches are integrated with policy administration system, producer management system, underwriting decision engine, and user portals (agents, policyholders, etc.). The STEP e-apps and Application Workbench user interfaces bring customer delight with its ease of use and accessibility.

The STEP platform’s e-apps and reinsurance underwriting workbenches can be customized to work with the in-house STEP Underwriting Decision Engine or carrier-chosen Re-Insurer’s Decision Engine, which drives the ‘Straight-through Processing’ capabilities.

Press Release

Features

The state-of-the-art STEP platform is a gateway to McCamish’s industry-leading life and annuity products and policy and producer management platforms. The platform provides companies with the tools to achieve:

- Product-driven application data entry and data validation

- Omnichannel application capabilities, including direct-to-consumer and Agent e-app

- A wide range of life and annuities product support

- Electronic forms and e-signatures

- Reflexive questionnaire based on medical conditions, occupation/avocation, and ICD 10 codes and NAIC classifications

- Automated workflow routing — via the Business Process Modeling and Notation (BPMN 3.0) standard

- Automated underwriting and in-force underwriting

- Straight-through processing and electronic approvals

- Case management and suitability

- Requirements management

- Validation and integration with external consumer databases

- Real-time dashboards and portals for agents, carriers, and policyholders

Business Architecture

New Business Acquisition

The STEP New Business Platform will enable companies to launch new, individual, or group life insurance products, as well as update existing products to keep pace with rapid changes in the market. Our STEP New Business platform delivers a straight-through solution for origination, issue, underwriting, claims, and policy administration of insurance products.

The STEP New Business Platform enables carriers to fast-track product launches through its highly configurable low-code/no-code architecture.

The New Business Acquisition component collects and tracks information from an initial policy quote through the issuance of the actual policy. It enables companies to achieve their strategic objectives by delivering:

Ease of use

- Quick installation

- Easy to understand

- Broad based with the ability to handle multiple forms of distribution and products

- Readily integrated with other aspects of the business

- Real-time information, 24 x 7 decisions

- Reduction in errors due to rule-based ‘In-Good-Order’ requirements

-

Application Workbench

The STEP platform provides an extensive Enterprise Portal with integrated document management, task management, and workflow capabilities to fully manage life and annuities new business origination. Our platform provides robust features such as:- Automated workflow and case management features for agents

- Prospect and lead management

- ‘My policyholder’ feature for collaboration and policy management

- Product-driven application data entry and data validation

- Reflexive questions and answers

It also delivers full support for new business origination such as:

- Universal Life

- Variable Universal Life

- Interest-Sensitive Whole Life

- Traditional Life (Par, Non-Par, Term, etc.)

- Deferred annuities

- Variable annuities

- Payout annuities

- Combo products

It is a powerful straight-through processing engine for underwriting and includes:

- Customized sales illustrations and quick quotes

- Configurable agent workflow

- Agent credentialing

- Document management

- Integrated OCR solution

- e-Signatures

Underwriting

Our New Business Acquisition platform for individual and group products provide customised online workbenches for streamlined internal and external workflow management.

The platform facilitates straight-through processing with our high-powered engine that features:- ‘My Tasks’ that offer task management queues for each underwriter

- Manual ‘Referred-to-Underwriter’ cases based on decisions deferred by underwriting recommendation engine

- Configurable attributes such as face-amounts, specific demographics, or other business rules that determine diversion of cases to underwriting task queues

- Re-assignment of cases by underwriting supervisors

- Detailed risk assessment worksheets with case details for applicant information, product information, disclosures, mortality factors, and external data

- Discrepancy management and risk class assessment

- Manual overrides and additional requirements management

- ‘What-if’ scenario building for easy evaluation based on variable data input

Applicant Portal (Direct-to-Consumer)

The Applicant (Direct-to-Consumer) Portal allows the applicant to initiate and complete the application during the new business process flow. The applicant can complete all application requirements, including e-signatures and authorizations. The applicant can download the completed PDF rendering of the application.

On acknowledgement and acceptance of the policy, the applicant is guided into the Policyholder portal and enables all the policyholder self-service functions.Group Life Insurance

In addition to our robust individual insurance origination, administration, and claims processing, the STEP platform offers a Group Life Insurance platform, which is ideal for affinity or employer group enrollment.

Through flexible templates, the STEP platform enables customizable branding and user experience for affinity groups and is easily linked to the affinity group’s website. The product affinity group combination serves to drive the workflow, underwriting, and form rendering. Collaboration tools manage customizable ‘My Application’ and ‘My Benefits’ features. The Identity Management feature offers flexible validations and ensures that affinity group member identification is authentic and secure.

Self-service functionality is available to the affinity group members and group management and reconciliation functions can easily be delegated to affinity group administrator or a third-party administrator (TPA).

The Employer Group Enrollment portal offers easy administration of employer groups and provides:- Preloaded enrollment data integrated with payroll/prospect feed

- Easy-to-use automated workflow

- Collaboration features for managing ‘My Application/My Benefits’

- Product-driven application data entry and data validation

- Reflexive Q&A

- Support employee self-service using the Enrollee portal

- Easy delegation of group management and reconciliation functions to an employer benefits administrator or a similar role

e-Apps

The STEP platform offers customized portals for external and internal roles with configurable e-apps that feature editable Q&A building with branching logic. Our system also provides an easy-to-use, friendly interface for direct-to-consumer e-forms.

Our Product Configurator facilitates rapid design of e-forms, such as:- Standard ACORD forms

- Carrier customized forms

- State variations

- Support for multiple hierarchies and categorization of plans

- Multiple options for benefit levels and coverages

- Supports plan components across all life and annuity (L&A) spectrum — combo products

- Supports all business rules through underwriting guidelines and validation rules

- Supports uploadable and configurable build charts and product premium rates

- Rendering of e-forms into PDFs for filing

In addition, our system offers reflexive questionnaires for medical underwriting such as:

- ICD 10 correlation for drill-down questioning of detailed medical conditions

- Extensive drug database to capture and correlate prescription drug data to disclose medical conditions

e-Forms

The STEP technology framework allows for configurable e-applications with editable form Q&As with branching logic based on the product forms. The e-applications generate standard ACORD forms for L&A products and a corresponding TXLife ACORD 103 message based on these forms.

The forms can be customised as per carriers, and each version of the form can be tracked and executed within the system based on effective dates. The Product Configurator allows for rapid configuration and versioning of e-forms along with management of state variations and additional forms requirements. The e-forms and e-apps support multiple hierarchies and categorization of plans and are dynamically rendered for multiple options for benefit levels and coverages.

The product templates offered within the STEP platform for Life, Accident, and Health products support plan components across all L&A spectrum. This allows for rapid configuration of ‘combo’ products. The e-forms support reflexive questionnaires for medical underwriting, and standard reflexive templates are offered for avocation and occupation questionnaires. The incorporation of master data such as ICD 10s, BLS occupations, and SIC Industry codes allow correlation for drill-down questioning, based on the applicant’s responses to medical conditions and occupations. Similarly, the STEP platform maintains a National Drug Database to capture and correlate prescription drug data to disclosed medical conditions. All the lookups to the master data are available in the e-forms for display and validation during the application process.

Additionally, underwriting guidelines and validation rules embedded in the e-forms as configurable business rules and support for uploadable and configurable build charts and product premium rates are pre-built during the product configuration.

The e-forms are rendered into the filed format PDF forms, and e-signatures captured during the application process are embedded into the rendered PDFs as ‘true’ signature images.

The e-form framework within the STEP platform can be overlaid with carrier branded templates, and the entire application flow (a series of e-forms to manage the entire application process) can be configured to a customer-friendly user experience as part of the ‘direct-to-consumer’ simplified issued products.e-Signatures

The STEP platform integrates state-of-the-art e-signature technology. Our system features e-signature functionalities such as:- Electronic signature for HIPAA authorization (includes mouse pad, signature pad, or clickwrap)

- Disclosures on paper or web pages to phone applicants

- Signature captured with proper timestamps/identity verifications

- Mouse-pad signature for capture of signature on web form using a computer mouse

- Embedded e-signature on a rendered PDF application form

- Signatures for agents and applicants captured as part of the application workflow process

- Integration with third-party partners for e-signature capture

Reflexive Questioning

The STEP configuration workbench allows configuration of e-apps and forms associated with the application processing, based on the carrier-designated underwriting rules or underwriting guidelines/parameters. Carriers may have reflexive questionnaires associated with certain application responses; for example, the aviation questionnaire can be used during the application process of a commercial pilot. The STEP platform enables the reflexive Q&A set configuration of the questionnaires as part of the e-app configuration. The platform has a pre-built library of Q&A sets that can be triggered based on certain attributes/value pairs encountered during the application processing. Carriers can leverage this pre-built library of Q&A sets or may configure their own Q&A sets. There is extensive reflexive Q&A support in the system, with multiple question data types supporting multiple answer types such as check boxes, combo boxes, radio buttons, etc. When used in conjunction with the STEP underwriting engine, the reflexive Q&A sets can be scored as per the underwriting guidelines, and these scores can be used to create the proper risk assessment profile of the applicant.

The Reflexive Q&A sets within STEP leverage standard master data sets such as:- ICD-10 diagnosis codes

- NAIC industry classifications

- BLS occupations

- NDC drug codes

- Provider data sets

Quotes

The STEP platform integrates with VPAS policy administration system where product configuration allows for premium rates to be configured for each component of the product at the plan component level. These premium rate quotes are computed as part of the coverage selections and presented to the applicant during the new business process flow. The premium rate quote, when combined with the risk assessment engine, presents the most accurate rate quote an applicant will be offered prior to the final underwriting decision. A quote history is maintained as part of the application process and quotes generated during the process are maintained in record for the case.External Data Integration

The STEP platform contains pre-built web services connections configured for incorporation of external data from consumer database sources. The external data can be utilized for straight-through validation, reconciliation, risk assessment, and processing of the transactions during the entire life cycle of the product. These straight-through data interfaces provide real-time data and can be leveraged by the platform for proactive monitoring of policy and claim data.

The STEP data sources are available as configurable, secure RESTful web services. The STEP infrastructure enables fully configurable external data message formats and can be retransmitted to downstream policy administration systems in a secure HIPAA-compliant message. The STEP technology stack has a rule-based data interface orchestration framework.

Straight-through data sources are implemented in the STEP platform and are readily available across the New Business, Underwriting, Policy Administration, and Claims functions. The platform can assess data sources such as:- Motor vehicle records

- MIB checking service

- Prescription data

- Identity verification

- OFAC and Patriot Act

- Credit Bureau

- Address validation

- Agent licensing/credentialing

- Compliance

- Lab orders/paramedical exams

Automated Underwriting

The STEP platform creates an automated, streamlined underwriting process. It incorporates rule-based risk assessment that enables smarter and faster underwriting decisions. Our automated process improves the overall underwriting cycle efficiency by lowering underwriting overhead, reducing costly errors, and eliminating manual efforts.

The requirements for underwriting life insurance products are unique. STEP’s powerful underwriting platform fully handles the complexity of L&A products. Our web-based system includes a stylized, reflexive applicant questionnaire that is conducted and completed via OMNI Channel Customer Support. Based on the applicant’s answers and the established rules-driven underwriting guidelines, the application is electronically processed and directed to the Underwriter’s Workbench.

The Underwriter’s Workbench provides for a consistent underwriting discipline and acts as a dashboard for the underwriter to request, collect, and review all the requirements necessary to evaluate the applicant’s insurance risk.

Automated Risk Assessment Engine

Our Automated Risk Assessment Engine speeds the underwriting process by swiftly identifying policy-worthy applicants and high-risk candidates. The features include:- Configurable knockout rules

- Attribute/condition-based risk classification

- Straight-through validation and reconciliation with online external consumer data

- Flexible rules-based credit/debit scoring

The STEP Engine Framework offers services such as:

- Carrier-designed underwriting parameters/underwriting guidelines

- Reinsurer ‘black box’ mortality assessment engines

- Hybrid solutions for complete flexibility to match reinsurance treaties

- Automated routing of cases for underwriting based on:

- Product guidelines and locale attributes

- Coverage selections such as face amounts, riders, etc.

- Specialized medical underwriting guidelines

- Automated Requirements and Correspondence Management

- Automated e-issuance

Requirements Management

The requirements within the STEP platform are defined at the process function level for a specific carrier product. During product configuration, requirements are defined as certain methods/functions that need to be invoked as part of the event processing during the life cycle of the product. For example, a requirement may be configured to invoke or attach a certain disclosure for a specific state variation during the application process.

The requirements can be chained and, in the example above, a review followed by an e-signature can be added as additional chained requirements. All the requirements are managed using the BPMN standard and configured as part of the carrier/product configuration. The STEP platform has standard templates for requirements at the following process levels:- Application requirements

- Underwriting requirements

- Compliance requirements

- Policy issuance requirements

- Policy endorsements/amendments requirements

- In-force UW requirements

- Claims processing requirements

These requirements templates are available for life insurance products with associated standard riders.

Compliance

Straight-through processing within the STEP platform enables credentials management, validation, and licensing fulfillment using external data sources and providers. Centralized product configuration and management of product versions based on locale and effective date allow to build compliance check framework in variations of the product. e-Apps and variations of product filings for reflexive questions or underwriting guidelines can be easily managed using the product configuration capabilities in the STEP platform. All form templates and requirements/disclosures/authorizations, etc., are maintained within the integrated STEP document repository for audit and compliance purposes.

Business analysts at the carrier compliance departments can easily manage the product variations and all the compliance elements associated with a product during its life cycle.

e-Approval

The STEP platform enables e-approval of policies via a robust platform that offers:- Automation of application processing

- Instant decision making with automated underwriting

- Document management

- Requirements management

- Correspondence generation

The STEP New Business e-app portal features enable applicants and policyholders and allow the applicants to review and e-sign documents and policies within the system, prior to issuance. The policy can be bound instantly, and policy pages and policy language can be assembled based on product structure and policy provisions. The entire policy can then be dispatched to the applicant for review and acceptance within minutes of the final action occurring on the policy.

The STEP platform can reduce the ‘apply-to-issue’ cycle time for simplified issue or instant issue life insurance products from days to simply hours, resulting in greater efficiency, improved customer satisfaction, and lowered costs.

Routing and Task Management

The STEP platform utilises BPMN 3.0 as part of the technology stack. This allows the workflow routing and task management to be configured as an integral part of the product configuration. The routing and task queues for a specific organizational unit are defined first and then workflow rules based on certain attribute/conditions are designed to route the tasks to specific roles during the workflow.

Each individual’s roles and the associated tasks can be managed using the same set of product rules. These rules can be configured to automatically manage task loads as well as for monitoring and measuring productivity metrics during the processing of insurance policies.

Capabilities

Our new business and underwriting services and solutions span the entire life and annuities value chain, delivering quickly and reliably for lower cost. These enable companies to reduce time to market for new products, expand globally, streamline management of complex distribution channels, and penetrate new markets. The Infosys McCamish STEP platform enhances business competitiveness by optimizing and transforming new business and underwriting processes and delivering accountability for high-quality service to the customers, agents, and case management/underwriting office.

Our offerings

Service-oriented architecture

- Web service integration

- ACORD standards

Plug-and-play with carrier software

- Decision Engine (optional)

- Producer Management System and related portals (optional)

- Policy Administration System (optional)

- Policy Holder Portal (optional)

- External electronic issuance (optional)

Endless scalability

- Multi-carrier, multi-product

- Customisable business process and workflows

Application capture

- Direct-to-consumer straight-through processing

- Electronic application entry

- Electronic feed import

- Paper application

- ACORD/DTCC/Custom

Application fulfillment

- Reflexive questionnaire

- IGO identification and tracking

- CC/EFT payment with application

- Requirements

- Correspondences

Plan setup and enrollment

- Plan setup

- Census data import

- Enrollment processing

- Agent license validation

- Business rules

New Business Underwriting and In-Force Underwriting

- Case management

- Suitability

- Underwriting

- Auto-decisioning