Finance and Accounting

Live enterprise - influencing a finance organization’s evolving needs

The world has seen a digital revolution and business, operating models changing with it at a rapid pace. Enterprises need to keep abreast of the same and be alive to opportunities and challenges that come along. Additionally, the pandemic has added its own challenges and learnings that need to be factored in. An enterprise primarily consists of people + solutions and when connected (digital brain + human brain) they come alive…

The promise and peril of a digital future, e.g., the dot.com boom and bust, emergence of social media and new technologies such as AI/ML, Cloud, Blockchain and IOT, have all converged. This convergence has coincided with the evolution of the next generation of customers and employees who are aware of these changes and their expectations is beyond sustainability, to value creation. They expect intuitive decisions (predictive and prescriptive), responsive value chain, zero-latency (instant simulation and micro feedback) and lastly, bigger experiences.

In short, data is crucial to establish a company culture with a basis in human-ware principles. An enterprise constitutes of people (human brain) and when they are connected to systems and platforms (digital brain) in an eco-system, they sense and produce signals. A series of these signals become learnings and help craft solutions that can empower organizations to be Live Enterprise.

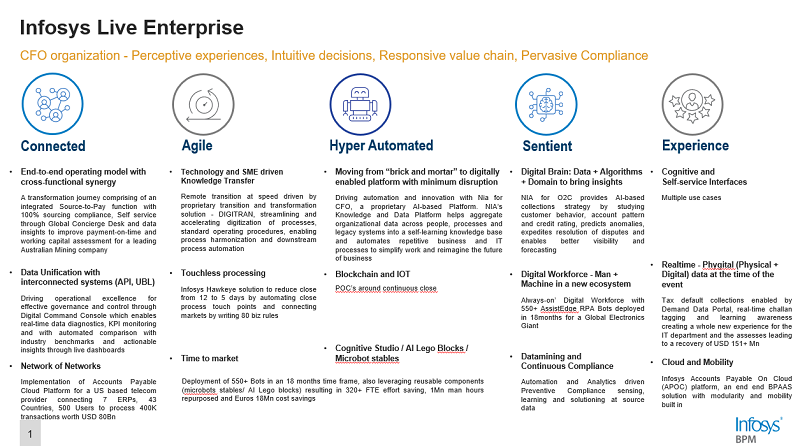

Creating a Live Enterprise for finance organizations rests on the following five pillars:

Infosys Live Enterprise for accounts payable, for instance, has enabled the process cycle to sense, learn and adapt and be connected always, taking the experience and processing capability to the next level. The implementation of a cloud platform for a telecom provider gave us compelling results, with 7 ERPs connecting 500 users across 42 countries, processing 400K transactions worth $80 Bn. Similarly, for O2C, the ability of the Live Enterprise suite to sense the future and evolve strategies has positively impacted the collection process.

Our platform on O2C for CFOs, ERP management, customer behaviour mapping from voice software, credit rating monitoring and so on, that enable and evolve AI-based collection strategy, is a step in the direction of becoming truly alive as an organization. The agility and quick-paced decision-making that Infosys Live Enterprise facilitates, has also supported us in deploying over 500 Bots for a major client, within 18 months, while leveraging reusable components (microbots stables/ AI Lego blocks). Similarly, the ability to use AI to sense the patterns that emerge from processing has helped in building preventive compliance.

A survey of C-suite executives and F&A professionals commissioned by automation software business BlackLine discovered that under 30% of respondents are confident that the financial data they use for financial analysis and forecasting is accurate. A majority of the respondents also pointed out that the lack of visibility and access to real-time data could impact a company’s ability to respond effectively to volatile changes in the market and in managing business strategy and continuity. Over 40% of the business leaders stated a higher focus on financial scenario planning and stress testing to tackle the impacts of COVID-19. Since the source of this crucial data is the finance function, CFOs and their teams are increasingly assuming a more pivotal role in an organization’s market strategy execution and financial planning.

In essence, Live Enterprise brings Value beyond Sustainability by making a CFO organization adaptive, future-focused, a nerve-centre connecting internal and external stakeholders and providing a real-time view of financials in a highly compliant environment. And when these dots connect to aggregate in an enhanced Net Promoter Score, the potential of Live Enterprise for finance is truly realized.