Automation technology has renovated the banking and financial industry rapidly, driving processes efficiency, personalised user interactions, and effective risk management processes. Open banking is one of the key automation trends appearing in the banking sector. Open banking is a process that allows third-party providers (TPPs) to access customer’s financial data from banks with their consent. This data can be used to supply varied innovative financial offerings. This opens new opportunities for the development of new products and services that help both banks and their customers. Automation can be used to streamline the open banking process.

Understanding the digital levers of open banking

Digital automation use cases in open banking through AI are revolutionising the financial services industry by enhancing efficiency, security, and personalisation. Digital levers are the tools and technologies that can be used to automate the open banking process. These levers include:

- Application Programming Interfaces (APIs): allows third-party providers (TPP) to securely access financial data from the banking system.

- Data analytics: can be used to analyse financial data and identify patterns and trends in customer transactions.

- Machine Learning (ML): can be used to create predictive models that are used to provide personalised financial insights.

- Artificial Intelligence (AI): performs automated tasks such as fraud detection and customer service.

The use of automation and digital levers in open banking is still in its initial stages, but it has the potential to revolutionise the way we interact with our banking and other financial systems. Automation makes open banking more efficient, secure, and personalised. Below is an example of automation and a use case of digital levers in the open banking process:

A banking user wants to track their spending using a TPP. The customer approves the TPP to access his financial data. The TPP uses automation to classify transactions and identify spending patterns. The TPP uses data analytics to give a personalised spending report to the customer. The TPP also uses ML to develop a predictive model with forecasts that help customers plan for their budgets and expenses.

The above scenario is a good example of the usage of automation and digital levers in open banking to make it more effective and personalised. As business automation and digital lever technology continue to grow, it is expected to see even more innovative applications in open banking in the coming years.

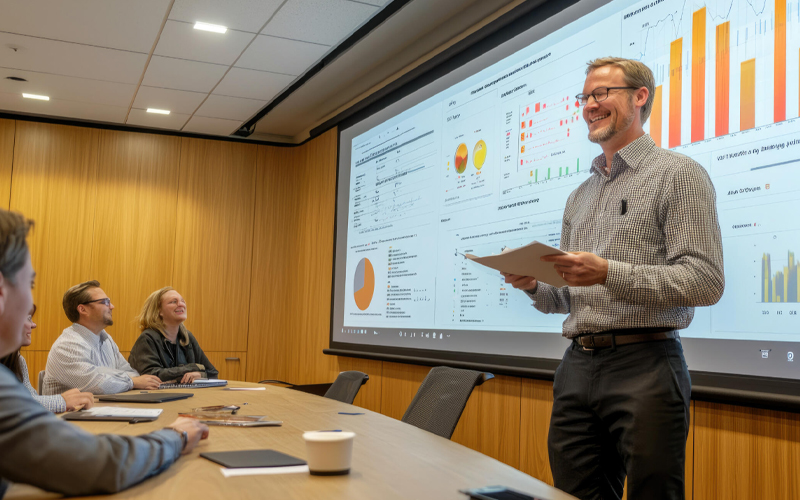

Popular use cases in open banking

Open banking, driven by data and focused on customer experience, sets up a perfect platform for innovative technologies like RPA, AI, ML, NLP, and Gen AI. Below are some use cases in open banking.

RPA (Robotic Process Automation):

- Automating repetitive tasks: Streamlining activities like account opening, loan processing, and compliance checks.

- Data extraction and aggregation: Extraction and consolidation of data from various sources, thus improving accuracy and efficiency.

- Generating standardised reports: Automating report generation using real-time data, enhancing data transparency and decision-making.

AI and ML:

- Personalised monetary management: Analysing customer data to offer personalised financial advice, budgeting tools, and investment recommendations.

- Fraud detection and prevention: Finding suspicious transactions in real-time, leveraging ML algorithms to adapt to evolving fraud patterns.

- Credit risk assessment: Using AI models to assess creditworthiness more accurately and dynamically, expanding access to financial services.

NLP (Natural Language Processing):

- Conversational banking: Build chatbots and virtual assistants for personalised customer service, answering questions, resolving issues, and handling transactions.

- Sentiment analysis: Analyse customer feedback and social media conversations to understand customer sentiment and improve product offerings.

- Document processing: Extract key information from unstructured documents like agreements and contracts, automating data entry and analysis.

Generative AI:

- Creating personalised financial content: Generating reports, summaries, and educational materials tailored to individual customers and their financial goals.

- Simulating financial scenarios: Developing AI-powered tools that simulate the impact of financial decisions, empowering customers to make informed choices.

- Fraudulent content detection: Generating synthetic data to train AI models for fraud detection, improving their accuracy and reducing reliance on real customer data.

As you can see, automation and digital levers can be used at every stage of the open banking process to make it more effective and secure for both financial companies and customers. It is to be remembered that open banking regulations and data privacy concerns need to be carefully considered during implementation. Also, to be noted are that ethical considerations and responsible AI practices are crucial in ensuring fairness, transparency, and trust in open banking ecosystems. By harnessing the power of these tools and technologies, open banking can unveil its full capability and potentially offer a more personalised, efficient, and secure financial experience for all.