Sourcing and Procurement

Procurement Challenges in Die Cast Aluminum Parts

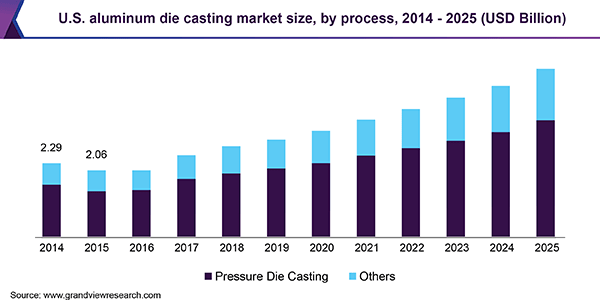

The global demand for die cast aluminum parts is growing at an accelerated rate, with an estimated compound annual growth rate of between 4.9% to 10.1%. The industry is expected to reach 48.93 billion by 2025.

The Aerospace and Defense Impetus

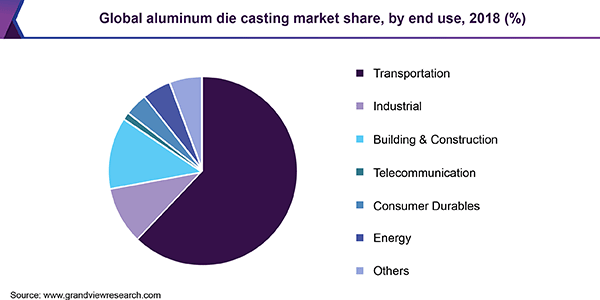

A major driver in the market is the growing demand from aerospace, defense and telecom industries. Because of the worldwide push for increased energy efficiency, the aluminum die casting process and forging techniques are seeing increased adoption in the aerospace and defense industry.

These and other lightweight alloys are preferred over steel in the manufacture of aircraft bodies and equivalent parts, as these metals reduce the weight of the overall aircraft. As the industry grows, manufacturers will have to adapt their sourcing strategies to accommodate growing demand with limited supplier capacity.

Key Challenges in Sourcing Die Cast Aluminum Parts

Single Source Relationships:

In the case of one of our major aerospace clients, most die cast aluminum parts are sole-sourced due to the tooling and amount of engineering and development efforts involved in part design and production. The First Article Inspection Report (FAIR), where the customer has to verify all dimensions of a part, can be too cumbersome and time-consuming to have multiple sources and also, in some large components, the volumes were not attractive enough to source to multiple suppliers.Transportation:

In large engine and industrial applications, the size and weight of the components limit sourcing options. Some large die cast parts are too large to consider suppliers out of a certain geographic region, and manufacturers must select die cast suppliers in close proximity to their plants due to the transportation costs.Capacity Constraints:

When die cast suppliers reach full capacity, it takes significant capital investment to add capacity or manpower. This inability to add capacity quickly limits the ability to meet customer requirements when there are significant increases in customer demand.Productivity and cost savings:

The sole-source nature of the supply chain, the inability to quickly add capacity, and the regulatory environment make it difficult to engage in the traditional sourcing levers of regular RFP, RFQ, and eAuction, among multiple qualified sources. This makes the goal of driving annual cost savings more challenging.Long lead-times and lead time increases:

Lead-times ranging from 6 weeks to as long as 26 weeks require customers to have forecasts as accurate as possible and also limits flexibility when there is fluctuating demand.

Strategies to Mitigate Procurement Risk and Drive Productivity

1. Engaging the possibility of Low Cost Country Sourcing Options?

With the sharp increases in global demand, suppliers in Taiwan, India, China, and Eastern Europe are rapidly expanding capacity. However, due to defense and military requirements, clients need to understand if parts can be sourced in lower-cost regions with more capacity and flexibility.

In the United States and Europe, ITAR (International Traffic in Arms Regulations) requirements limit the countries some parts can be produced in heavy manufacturing industries such as aerospace.

2. Dual Sourcing:

Typically, parts in this category have multiple suppliers with the capability to produce the components. Some clients dual source with committed volume to ensure capacity commitments, improve supply risk and create a competitive environment to reduce part cost.

3. Blanket Purchase Orders over 24 to 36 Month Time Horizon:

One of the ways suppliers can mitigate risk and have dedicated capacity is to place orders over two to three years for volume leverage to get the best cost and to get committed capacity over a longer period of time. This will allow suppliers to plan and build with dedicated multiyear customer commitment.

4. Leverage New or Alternate Technology:

Implementing Hog out and Machining Process to mitigate die cast risk investigate alternate material such as plastic, composite material or Iron.