Digital Business Services

Enhancing Customer Experience With an Analytics Driven Solution

Customer feedback plays a vital role in any financial institution, as dissatisfied customers are likely to approach regulatory authorities in order to resolve their issues. Hence, it is important for banks to have an intelligent analytics-enabled solution that is capable of proactively handling customer queries and complaints. Infosys DTS research shows how such an analytics-driven solution can use data on internal and external complaints to enhance the customer experience across different products and services.

The Focus Area

Customer feedback plays a vital role in any financial institution, as dissatisfied customers are likely to approach regulatory authorities in order to resolve their issues. Hence, it is important for banks to have an intelligent analytics-enabled solution that is capable of proactively handling customer queries and complaints. Infosys DTS research shows how such an analytics-driven solution can use data on internal and external complaints to enhance the customer experience across different products and services.

Such outcomes reflect negatively on the brand perception and satisfaction levels of customers, ultimately affecting the bank’s performance and customer retention goals. It is thus critical to meticulously handle all customer complaints and queries without negatively impacting the overall customer service quality. Hence, it becomes necessary to extract insights-driven data from every customer feedback and use such data to augment the customer experience.

Customer Service Challenges That Banks Face Today

Banks face major challenges in the following three areas of customer service:

- Understanding the touchpoints via which they engage with their customers and identifying the gaps in meeting their expectations, which could ultimately lead to losing them.

- Upholding the brand reputation and customer loyalty which are diminished by an increasing number of cases moving either to ombudsmen (a government appointed official) or regulatory services.

- Correlating and integrating the touchpoints of both internal and external (regulatory) complaints. This is a vital step towards creating an enhanced customer experience solution that could help avoid penalties from regulatory bodies, and to identify in advance those who have a higher chance of approaching a regulatory body.

Regulatory Bodies – Customers’ Last Resort

Regulatory bodies such as the Consumer Financial Protection Bureau (CFPB) receive complaints from dissatisfied customers on the products and services provided by their financial institutions. The complaints are mostly related to products involving bank accounts or services, consumer loans, mortgages, and credit cards, etc.

CFPB Complaints process

Lodging a complaint:

If customers are not satisfied with the solution provided by their bank for an issue with a product or service, they can lodge a descriptive complaint with the regulatory bodies.Getting answers:

Banks are required to respond to the complaints raised and resolve them at the earliest.Getting financial compensation:

If the regulatory body finds that the solution provided by the bank is outside the rules, both the customer and the bank then need to accept the regulatory judgment and take further steps as suggested by the regulatory body.

Infosys BPM’s Approach for Customer Experience Solutions

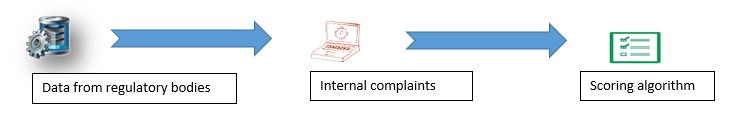

In order to resolve complaints and avoid the risk of losing customers, it is important for banks to assess the complaints registered with regulatory bodies and map the resulting insights to the complaints raised with them internally. Banks can opt for an analytics-based solution to analyze, correlate, and integrate the data from the regulatory body and internal complaints.

This, in turn, can help them understand the factors contributing to customers’ dissatisfaction and thereby predict those customers who are likely to go to the regulatory bodies to seek help for their problems.

The outcome of the actions outlined below can help create an enhanced customer experience solution for banks and avoid penalties from the regulatory bodies:

- Regulatory data

- Use past customer complaints data from CFPB (for major banks) to understand customer complaints patterns.

- Use NLP/deep learning techniques to identify hot keywords, themes, and sub-themes from the customer complaint narratives.

- Develop a sentiment score for each customer complaint and identify the intensity of the sentiments.

- Internal complaints

- Apply text analytics to the complaints data provided by internal departments to identify hot keywords, themes, and sub-themes.

- Identify major areas of concern such as maintenance fees, overdraft fees, and paper statement fees, as most customer complaints and waive off requests are related to these areas.

- Scoring algorithm:

From both the regulatory body and internal complaints, here’s how to get insights:- Match the hot keywords discovered from the regulatory data set with the keywords identified in the internal complaints data.

- Generate probability scores based on the keywords for different products and services (Bayes’ theorem).

- Identify based on hot keywords, the number of customer complaints that have a medium-to-high probability of being escalated to regulatory authorities, as each hot keyword holds a specific weightage.

Delivering Value with ‘Complaints Analytics’

With a deep dive into the complaints data, banks can measure customer experience around products and services and proactively identify and resolve potential compliance issues. This is possible by leveraging deep data-driven insights from internal and regulators’ complaints data.

By integrating both data sets, this process can help derive insights that enable banks to take necessary, timely actions, and reduce investments to further enhance the customer experience. These insights can have a positive effect on customer retention and also be leveraged to enable a competitive marketplace advantage.

Further insightsWith the help of this customer experience data analytics solution, further insights can be obtained from:

- Customer life-time value modeling to provide a customized solution for the complaints rather than selecting a ‘one-size-fits-all’ approach

- Targeted communication campaigns for new entries to build awareness on products, services and usage fees

- Topics modeling to understand the factors contributing to these complaints