Finance and Accounting

Bringing Value to Tax Compliance Solutions with Automation and Support Services

Today, interconnected global supply chains, complex international taxation systems, and the ever-changing nature of country-specific tax rules have made the job of staying tax compliant difficult for businesses worldwide. The associated regulatory requirements for indirect tax compliance and reporting are making businesses to explore solutions that can help with simplification, including indirect tax automation.

An overburdened and inefficient F&A

F&A departments constantly strive to meet tax compliance regulatory guidelines and prescribed timelines. Consequently, organizations end up spending significant resources, time, and effort in addressing such challenges in combating factors affecting tax compliance solutions are essential for effective management of sales and use tax obligations and ensuring accurate tax determination.

Significant resources in terms of people and time are dedicated to undertaking mundane, repetitive tasks involved in generating reports, making submissions, filling-up forms, and other activities for tax compliance & reporting. Also, multiple data formats and platforms across systems and locations lead to data duplicity, redundancy, and the need for manual data reconciliation and report generation in tax processes. Indirect tax automation can significantly streamline this process by reducing the need for manual data management, thus improving efficiency.

Digital technology to the rescue indirect tax automation

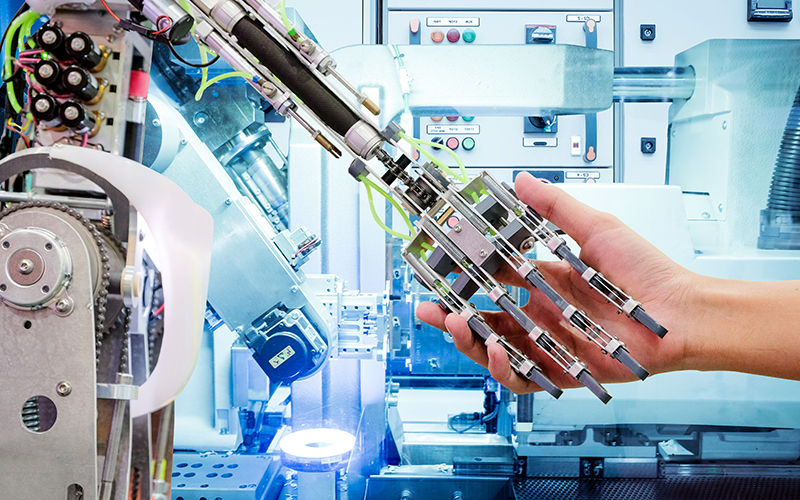

The digital transformation wave brings with it immense opportunities for businesses worldwide, particularly in the realm of tax solutions. Globally, companies are transforming and incorporating new digital technologies across processes, departments, and business operations to optimize resources and improve efficiency.

It has become imperative for organizations to adopt an integrated approach for tax compliance solutions management as well, with tax technology at the core. Indirect tax Automation of manual processes in taxation, RPA integration, and bundling with artificial intelligence through the right combination of people and technology is the way forward.

The multiple benefits of tax compliance & automation solutions

Deploying technology to manage tax compliance challenges is advantageous on several fronts, highlighting the significant benefits of tax automation:

Save time & effort:

Creating time-efficient processes through technology frees professionals and resources to be utilized for more strategic business responsibilities. Further, it ensures accuracy and removes risks due to human error in tax reporting, computations, and meeting timelines.Make informed decisions:

Consolidation of data into a single format and system makes it easy to access and generate reports for analysis of the company’s position in terms of indirect taxes such as VAT, GST, etc.Mitigate risks and plan ahead:

Automated tax checking puts in place a process for defining, scheduling, and executing compliance checks in time so as to manage and mitigate risks. It would help the management timely identify compliance issues, take corrective actions, and implement mitigation strategies.Gather valuable business insights:

Predictive analytic tools facilitate processing micro-level transactional data to derive valuable insights to be able to respond to tax authorities, and drive business decisions and strategy formulation.

Launching tax automation initiatives

The first step in this direction is the centralization of data and standardization of reporting processes and systems within different departments and countries within the organization. An effective starting point for automation is routine, rule-based data-intensive activities, along with transactional tasks in indirect tax reporting, utilizing advanced tax technology. Data captured through automation can thereafter be processed using advanced analytic tools.

Infosys BPM's integrated tax automation solutions

Infosys BPM’s deep expertise in enterprise reporting, analysis and planning, accounting, and tax support enables it to design, transform, and manage operations that deliver substantial business outcomes through efficient tax processes.

For instance, in the case of a global CPG major with revenues of over $76 bn, Infosys BPM implemented RPA and analytics for the reporting function that helped remove redundancies in the process, improved visibility, and greatly reduced costs and effort. The centralized reporting solution helped the client realize 20-30% savings, enhance productivity, and lower servicing costs by streamlining the tax calculation process.

For tax compliance solutions as well, Infosys BPM partners with clients to consolidate and harmonize their processes and meet all requirements.