Finance and Accounting

Embracing the Paradigm Shift: Transforming F&A with Blockchain

Blockchain technology provides for several applications in the finance & accounting (F&A) industry. Yet, the reality is that blockchain adoption for financial transactions is quite low. This is because of the challenges that come in the form of misconceptions around what the technology can deliver, and the lack of integration with existing solutions.

Let’s take a look at some of the current deterrents as well as possible applications, and understand how to leverage this technology better with F&A.

Current Challenges in Adopting the Blockchain Technology Shift in Finance

Blockchain adoption in finance has several associated challenges, and understanding them clearly is essential before deploying the technology for financial processes.

-

Talent:

Although blockchain has been around for over a decade, finding resources that not only understand the technology but have deep expertise in F&A is still a challenge. Given the shortage of resources, the right hire could also mean higher costs for organizations. -

Governance:

The control over information is decentralized for transactions with multiple participants, which can lead to a breakdown in governance. Adaptability to different governance and data security policies needs to be built-in. -

Regulations:

Blockchain attempts to overcome inefficiencies in processes. But a lack of regulation for the technology and its inability to adapt to new regulations and tax systems are a hindrance. For example, GDPR states that information should be alterable and erasable. But this goes against the immutable nature of blockchain. -

Scalability:

While Visa can handle an average of 1700 transactions per second, a bitcoin network can only handle 7 transactions. When stakeholders with different compliance and reporting standards get added to a transaction, the execution takes longer because of blockchain's decentralized and consensus-based mechanism.

Expected Impact of Blockchains on Finance Business

While blockchain works for certain financial processes, for those involving regulations or significant manual intervention, this technology might not be a good fit yet. However, here are some features that can lead to a positive impact:

-

Cost & Security:

Blockchain's use of distributed ledgers ensures that data is trustworthy, secure, and transparent. The benefit is the reduction of the cost and risks of maintaining a centralized database. -

Automation:

The technology allows the creation of smart contracts that can be coded with business logic. These contracts limit manual intervention and the risks from human error. For auditors, they can save time spent on testing transactions. -

Speed of operations:

As digital contracts can be settled in real-time, there is an improvement in efficiency and processing speed. With diminished dependence on IT systems and intermediaries, transactions become more peer-to-peer, such as in payment services.

While processes like general accounting, trade finance, and accounts payable are potential candidates for blockchain, the involvement of multiple vendors and banks with different data formats & standards could be a contributor to the technology’s slow adoption. The decision to adopt a new technology should take into account the willingness and ability of intermediaries and the capacity to fit into the existing technological ecosystem.

Amplifying Value with Digital Levers in F&A

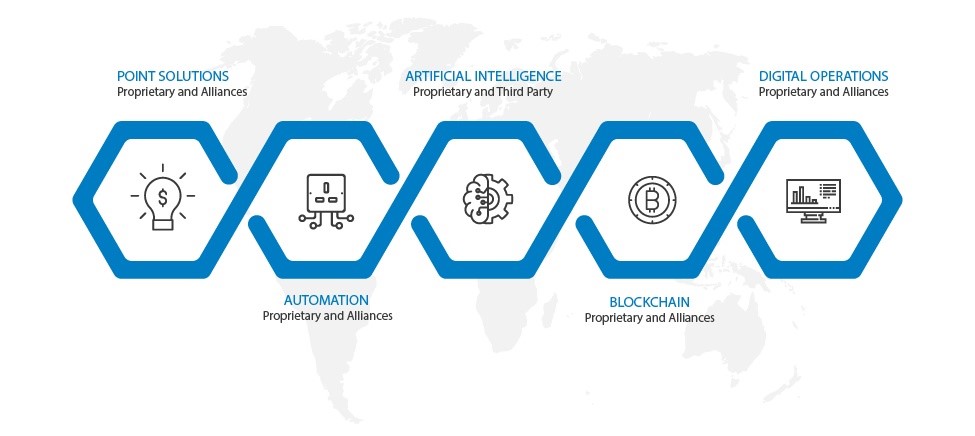

As blockchain technology matures, its applicability in F&A will continue to grow. However, rather than following a rip-and-replace method, blockchain is best utilized when integrated with the existing technology landscape. Infosys BPM is a leader in this space. Its Digital Finance Solution combines five levers to deliver a digital strategy for the F&A industry.

Blockchain forms part of this digital strategy along with best in class in-house and partner products, leading robotic process automation (RPA) solutions, 20+ AI business solutions and digital operations. By leveraging technology to imagine solutions for finance and with access to skilled resources, we help CFOs embrace the fundamental shifts they need to embrace in order to transform their operations.