Life insurance underwriting—the process of evaluating an individual's risk profile to determine policy eligibility and premium rates—is at a crossroads. Traditionally, it has been a vital component of the insurance industry, often involving extensive paperwork, medical examinations, and lengthy waiting periods. However, with advancements in technology and evolving consumer expectations, the future of life insurance underwriting is set for a significant transformation. This blog explores the emerging trends and innovative technologies reshaping the insurance landscape, offering a glimpse into a future marked by greater efficiency, personalization , and accessibility for both insurers and policy holders.

Key Innovations Reshaping Life Insurance Underwriting

- Data-Driven Underwriting

- Accelerated Underwriting

- Artificial Intelligence and Machine Learning Underwriting

- Tele-Underwriting and Virtual Medical Examinations

- Personalized Risk Assessments

Contemporary underwriting algorithms used Rx inputs, MIB, MVR, and other data points like credit scores. In today’s digital age, insurers are increasingly leveraging vast amounts of data to make more accurate risk assessments. This includes incorporating non-traditional data sources, such as wearable devices and electronic health records. By analyzing this data, insurers gain deeper insights into an individual's lifestyle, habits, and health, allowing for more precise underwriting decisions. Advanced analytics and machine learning algorithms process this information efficiently, enabling insurers to offer tailored experiences and more accurate pricing.

However, as insurers adopt data-driven approaches and wearable-based programs, transparency is crucial. It is essential to clearly communicate what information is collected, how it is stored and shared, and how the data will be used. Obtaining customer consent and the appropriate authorization before accessing their personal information is essential for building trust and ensuring regulatory compliance.

One of the most significant advancements in life insurance underwriting is the adoption of accelerated underwriting, which expedites policy approvals for low-risk applicants. This approach leverages automation and data analytics to expedite the underwriting process for low-risk applicants. By leveraging technology, insurers can access external data sources, perform risk assessments, and make policy decisions in a fraction of the time compared to traditional underwriting methods. This streamlined process not only reduces administrative burdens but also enhances the overall customer experience, making life insurance more accessible and convenient.

A key feature of accelerated underwriting is ‘Triage’, wherein an initial risk screening is conducted using a limited yet predictive set of applicant information. A major advantage of this model is that it streamlines accelerated underwriting by focusing on low-risk applicants or those whose risk class can be accurately assessed. A human underwriter typically steps in for applicants with negative indicators, enabling the company to strike a balance between the cost savings from removing fluid underwriting and the added cost of increased mortality risk.

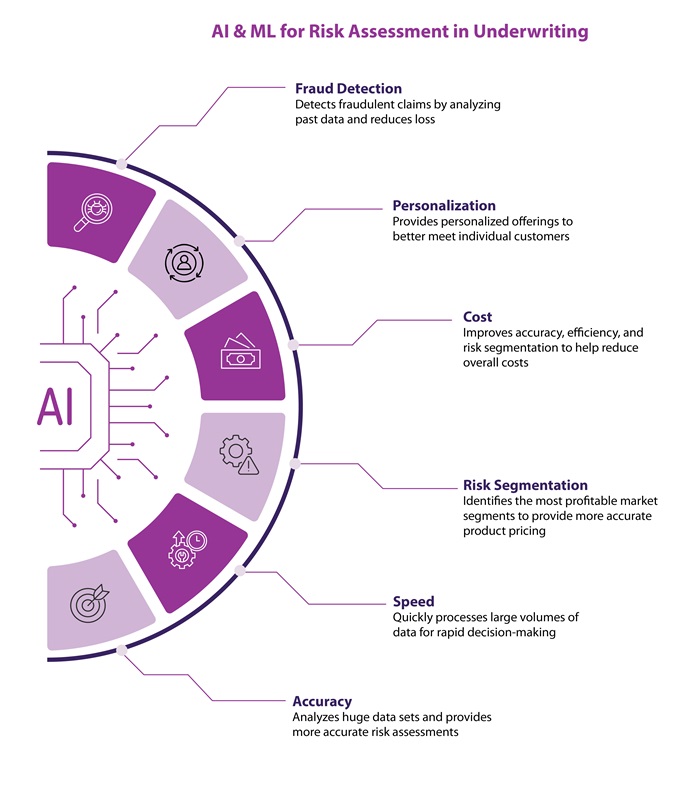

Like many industries, Artificial Intelligence (AI) and Machine Learning (ML) are changing the game in insurance, making processes smarter, faster, and more customer friendly. These technologies can analyze vast amounts of data quickly, identify patterns, and make predictions with remarkable accuracy. AI-powered underwriting systems can review applications, medical records, and other documents, flagging potential red flags for further investigation. Machine learning algorithms continuously adapt and improve from data, refining risk assessments and enabling insurers to make more informed decisions. By leveraging AI and ML, life insurers can enhance operational efficiency, improve underwriting accuracy, and remain agile in an evolving market, all while delivering a superior experience to their customers.

Traditionally, life insurance underwriting required applicants to undergo extensive medical examinations, which could be time-consuming and inconvenient. The rise of tele-underwriting and virtual medical examinations has significantly transformed the underwriting process, making it more seamless, accessible, and customer centric. Through tele-underwriting, insurance professionals can conduct remote interviews with applicants, making data collection efficient while reducing the dependency on in-person interactions. Similarly, virtual medical examinations, conducted through video calls or wearable devices, provide insurers with real-time health data, further simplifying and expediting the underwriting process.

These advancements help achieve two goals—firstly, they create the best-in-class experience for applicants, agents, point-of-sale representatives, and back-office distributors by streamlining workflows. Secondly, they enhance the quality of the information collected during the application process, contributing towards more accurate and informed underwriting decisions.

By adopting these innovative approaches, life insurers can achieve greater operational efficiency while meeting evolving customer expectations.

Life insurance has always been a deeply personal product. However, traditional underwriting processes often followed a one-size-fits-all approach, relying solely on broad risk categories of age, health, and occupation. Digital advancements are changing the game, and personalization is going beyond basic health metrics—by assessing factors like exercising frequencies, nutrition, and lifestyle choices, insurers can tailor policies to suit an individual's specific circumstances. This proactive approach not only ensures fairer pricing but also incentivizes healthier lifestyle choices, rewarding individuals for maintaining good health and encouraging long-term well-being.

To further refine risk analysis, insurers are beginning to tap into prescription histories, electrocardiograms (ECGs), and blood profiles to make underwriting decisions. By incorporating these biological data points, insurers can gain deeper insights into an individual's health status, enabling them to perform risk assessments with greater accuracy and create personalized policies.

Looking Ahead: The Future of Life Insurance Underwriting

The future of life insurance underwriting lies at the intersection of technology, data, and human expertise. As insurers move away from rigid, one-size-fits-all models, innovation-driven approaches will enable faster, smarter, and more personalized underwriting processes. Real-time data streams from wearable devices, AI-powered predictive models, and cloud-based platforms will not only streamline risk assessments but also tailor policies to individual lifestyles, creating a deeply personalized customer journey.

To stay ahead, insurers and financial advisors must adopt a forward-thinking mindset. Leveraging these innovative technologies will be crucial to navigate the changing landscapes of risk assessment, customer engagement, and policy management. As the industry continues to evolve, adaptability won’t just be an advantage—it will be the foundation of delivering seamless, future-ready insurance solutions.