Infosys BPM recognised as a leader in Everest Group lending services operations PEAK Matrix® assessment 2024

The lending operations market has experienced significant turmoil in recent years due to high interest rates and other macroeconomic factors, leading to reduced consumer activity. As a result, service providers are continuously innovating to meet local requirements and maintain a competitive edge. High-growth lines of business, such as mortgage, retail, and auto lending, have emerged as focal points.

Consumer demand is shifting toward younger, digitally savvy borrowers who prioritise experience and convenience over cost. To serve this evolving demographic, service providers are differentiating themselves by leveraging their partnership ecosystems and recent acquisitions to enhance their capabilities and accelerate time-to-market for new offerings. Investments in digital lending solutions and tools are helping to streamline the end-to-end lending life cycle and significantly improve the overall customer experience.

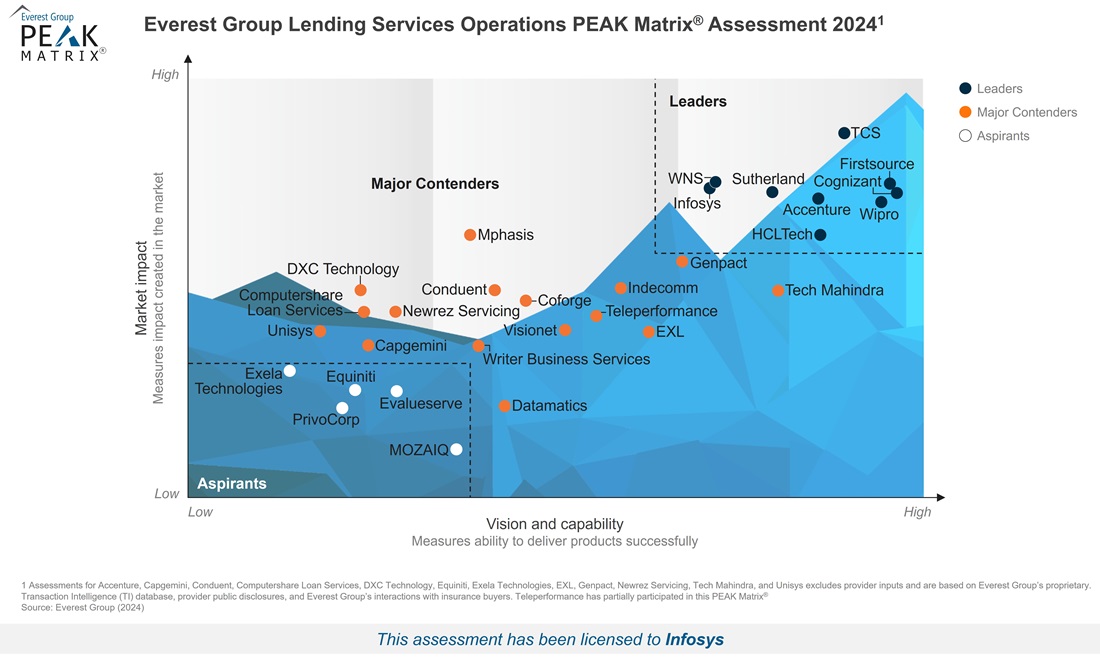

In a comprehensive assessment of 30 leading lending services providers based on their vision, capabilities, and market impact, The Everest Group has positioned Infosys BPM as a Leader in the Lending Services Operations PEAK Matrix® Assessment 2024, for its broad set of capabilities across the lending value chain and presence across major geographies.

Highlights

The following Infosys BPM efforts have led to this recognition:

- Infosys BPM has strategically expanded its lending portfolio stake with the aid of Stater NV, a wholly owned subsidiary of ABN AMRO. This move has enabled the company to capitalise on new European market opportunities.

- Infosys BPM’s substantial revenue, extensive customer base, and resilience during economic downturns have solidified its position as a leading provider in the lending market.

- By combining offshore capabilities with a robust onshore presence, Infosys BPM has effectively expanded its operations into new markets like Australia, Japan, and Malaysia, supporting its ongoing growth.

- Infosys BPM’s commitment to digital innovation and comprehensive client solutions has enabled it to weather the fluctuations of the lending market and maintain a consistent revenue stream.

- Through its Business-Process-as-a-Service (BPaaS) offerings and strategic partnerships, Infosys BPM is driving automation and digital transformation for mortgage banks and lenders, providing comprehensive solutions that streamline their operations.

“Infosys’ strategy for developing digital and end-to-end offerings, alongside traditional operations, has helped it remain a preferred enterprise partner. Infosys' BPaaS capabilities, its strategic venture with Stater NV, and robust insurtech partnerships have enabled it to capture new opportunities, resulting in its recognition as a Leader in Everest Group's Lending Services Operations PEAK Matrix® Assessment 2024.”

- Sahil Chaudhary, Practice Director, Everest Group

To download a custom version of the full report, please click here.

If you want to learn more about the lending services offered by Infosys BPM, click here.