Mortgage Operations and Digital Mortgage Solutions Services

Mortgage lenders across the world have been aiming at gradually reducing yearly costs and improving borrower experience within the limits of regulations. On the other hand, digital lenders are enabling ‘paperless’ processes that ensure quicker loan disbursement and full digitisation, which helps borrowers to buy at cheaper rates and close faster.

The leaders are responding with investments in technologies such AI, ML, RPA, and analytics, giving rise to digital mortgage operations, which will enable simplification and automation of the mortgage lifecycle.

Accelerating Your Digital Mortgage Experience for Superior Borrower Outcomes

Infosys BPM has significant experience in assisting lenders and servicers in their digital mortgage transformation journeys with:

Dedicated consultants bringing together digital acumen and solutions mindset including people, processes, and technology to streamline financial origination

A dedicated Mortgage Centre of Excellence (CoE) leveraging experience from over 50+ global mortgage clients to help you with cutting-edge best practices

A robust ecosystem of partner and in-house solutions across the mortgage value chain offering best of both the worlds — innovation and agility

Commitment to deliver and partner throughout your transformation journey, not just ‘advise’, ensuring a seamless experience in the industry

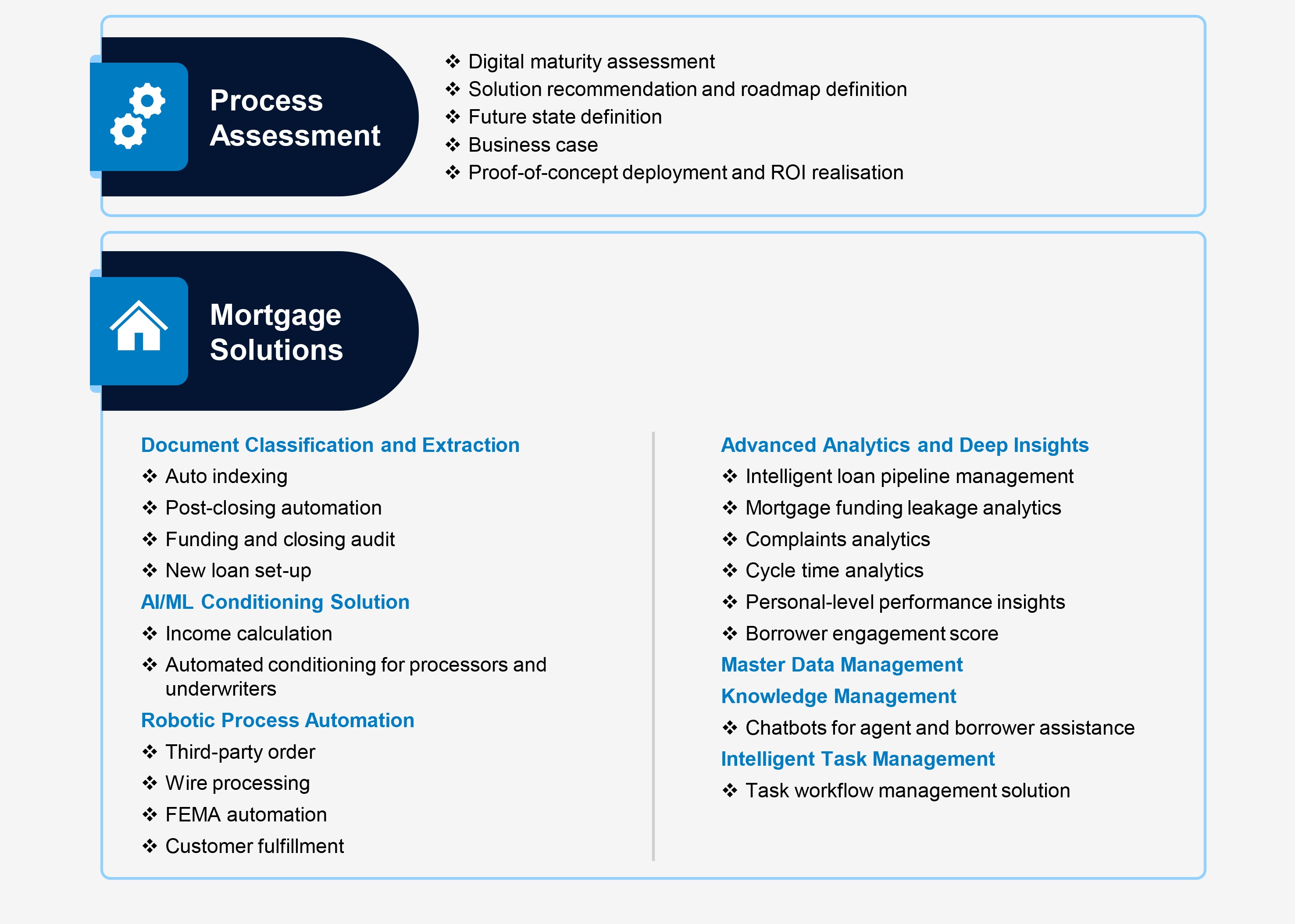

Our Digital Mortgage Service offerings for Lender

Infosys BPM digital mortgage solutions are part of the Infosys Live Enterprise suite, designed to simplify the online lending process. They are made up of business process digitisation solutions, with a primary focus on improving operational efficiency, enforcing better process controls powered by deep insights, and ensuring superior customer experience.

Automate mortgage lifecycle

Insights

Request for services

Find out more about how we can help your organization navigate its next. Let us know your areas of interest so that we can serve you better

All the fields marked with * are required