Overview

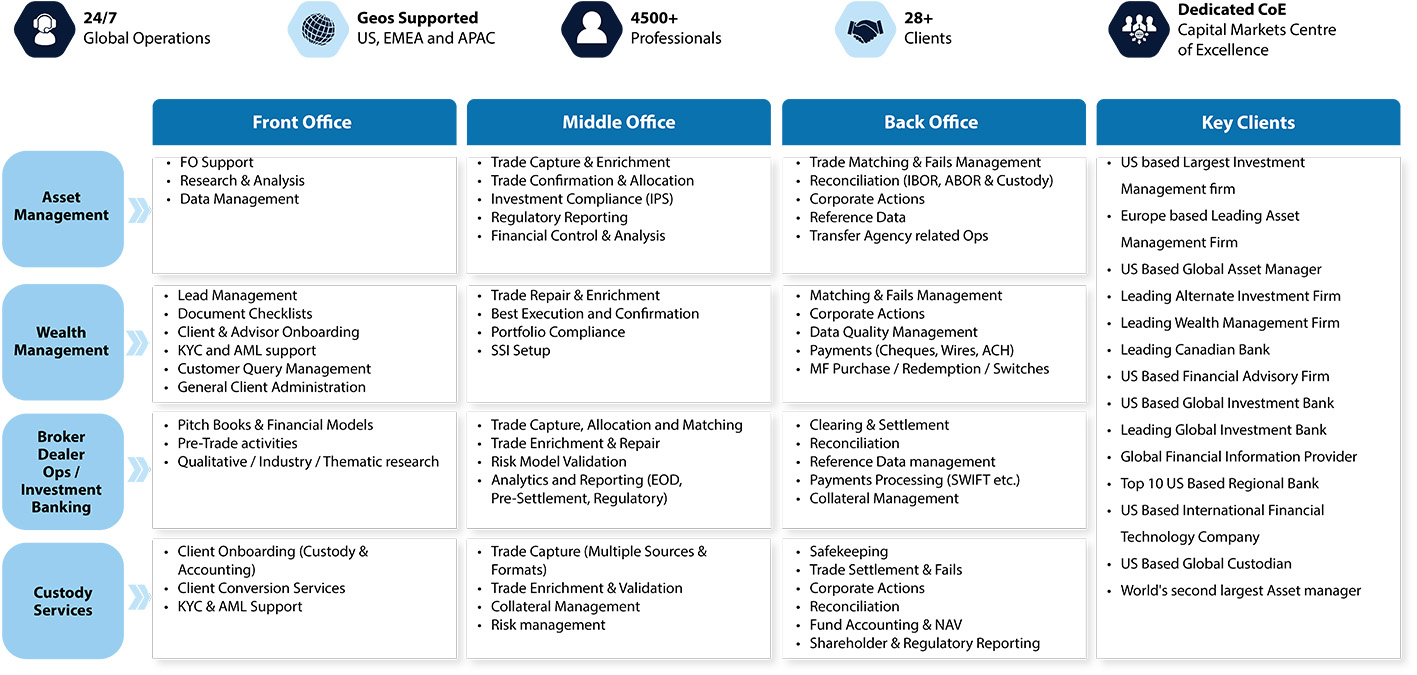

At Infosys BPM, we specialize in helping organizations navigate these challenges with confidence, combining deep domain expertise with innovative technology solutions and a consultative approach to problem solving.

Why us?

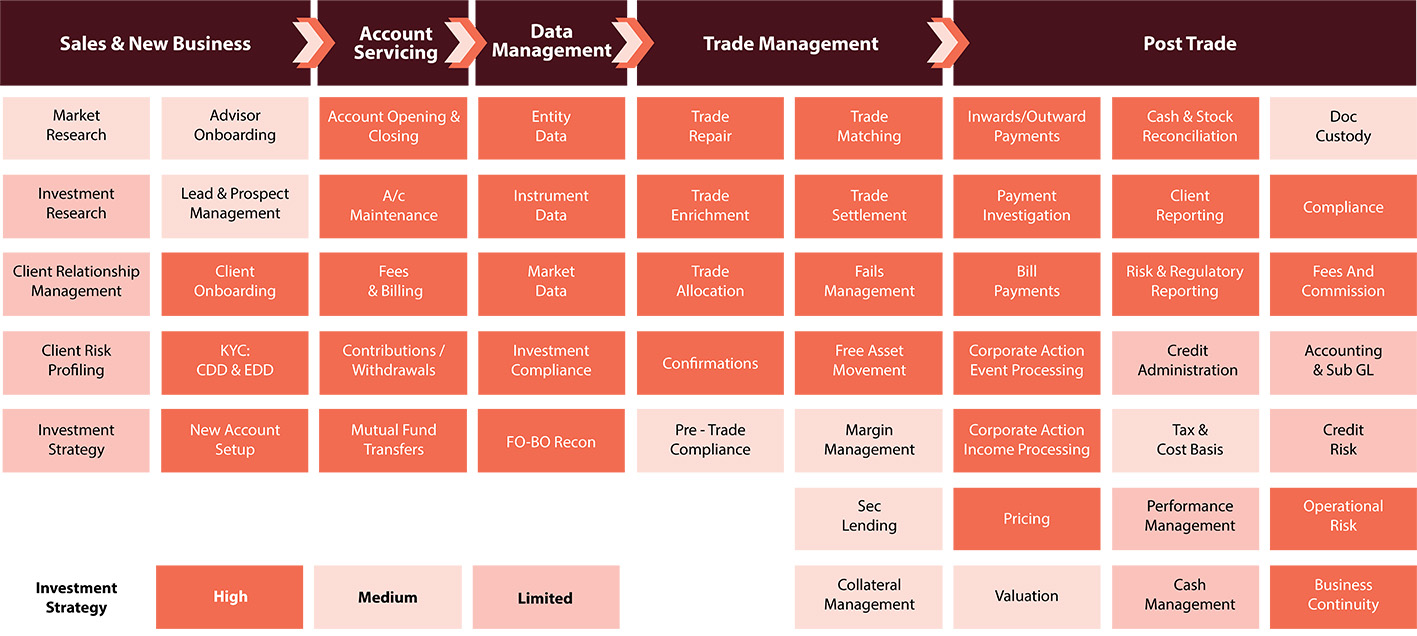

Infosys BPM has deep experience across the functional value chain of the wealth management domain. We have expertise across client onboarding, AML/KYC management, account opening, account administration, data management, trade management, reconciliations, payment, corporate actions, and regulatory reporting. We have a significant presence across the globe with over 500 professionals servicing clients from diverse locations. Our domain, industry, and change management expertise along with the use of industry leading platforms (Avaloq, Aladdin, Broadrdige Calypso, Murex, Smartstream, etc.) helps us provide the best solutions to wealth management firms. This helps our clients optimize the cost of operations while building internal efficiencies. We have partnered with multiple clients in their transformation journey and delivered significant business value.

A glimpse into client successes

- For a leading wealth management firm, we delivered 20-25% reduction in ops cost, 40% reduction in manual effort, 25% STP enhancement, and year-on-year productivity enhancement of 15%.

- Enterprise-wide KYC transformation for 80 million+ customers across 90+ geographies across all lines of businesses for an American multinational financial services group. We helped them reduce onboarding cycle time from 45 to 2 days, reduce KYC review cycle times by 20%, and improved in quality by 30%.

Key solutions

Finacle™ wealth management module

Full spectrum of wealth products and seamless integration of all front-to-back office tasks. Improves productivity of financial advisors and streamlines operations.

AI & Gen AI-powered profiling assistant

Revolutionizing contacts management by addressing labor-intensive inefficiencies. Improved Productivity, TAT, and data quality

Digital adviser

Gen AI-based adviser for advisory prompts and sentiment analysis. Advisor enablement and Client personalization.

Success Stories

Bringing values to businesses through our products and services

Request for services

Find out more about how we can help your organization navigate its next. Let us know your areas of interest so that we can serve you better

All the fields marked with * are required