Overview

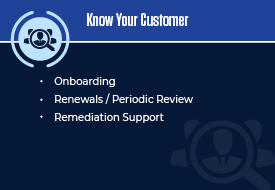

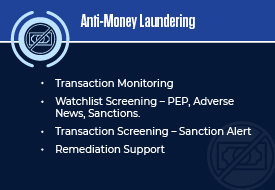

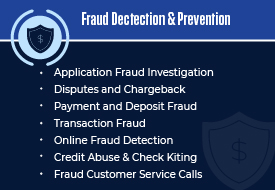

Infosys BPM Compliance practice helps banks transform their end-to-end KYC, AML, Trade Surveillance, and Fraud Detection & Prevention operations through our comprehensive services, process consulting, and next-generation technology-enabled solutions. We leverage our domain expertise and global delivery model to implement the banks’ target operating models.

Infosys BPM possess a strong Compliance practice with 750+ operations domain experts delivering 24 x 7 coverage for multiple clients across the globe. We apply our proprietary Process Progression ModelTM (PPM) framework to help achieve target operating model.

Why us?

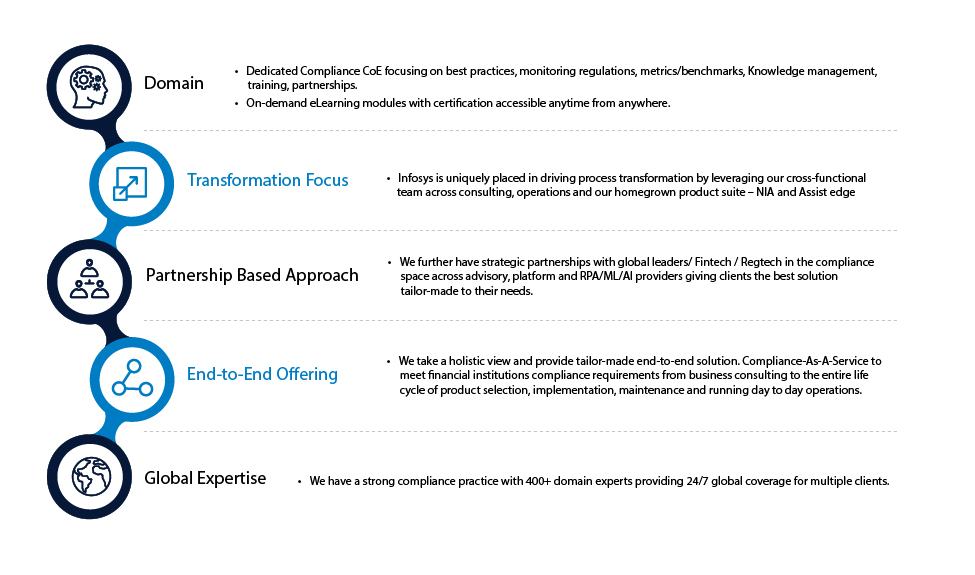

Infosys BPM is uniquely placed in driving process transformation by leveraging our cross-functional teams across consulting and operations as well as our homegrown product suite — AML Alert Workbench, Document Workbench, Risk Profiling Agent, and Digitization of Fraud Disputes. It consists of:

- A dedicated compliance CoE focusing on best practices, monitoring regulations, metrics/benchmarks, knowledge management, training, and partnerships.

- An on-demand e-Learning modules with certification accessible anytime from anywhere.

In addition, our Compliance practice delivers benefits to banks by:

- Reducing the total cost of ownership with an assurance to bring down the overall operations cost by 50–70%.

- Reducing false positives by up to 40% through operational and technological initiatives.

Furthermore, we have strategic partnerships with global fintech/regtech companies in the compliance space across advisory, platform, and RPA/ML/AI providers, thus delivering the best, tailor-made solutions to meet client requirements.

Our Compliance as a Solution is a customised, holistic, end-to-end solution that delivers compliance requirements to financial institutions, from business consulting through the entire life cycle of product selection, implementation, maintenance, and day-to-day operations.

Offerings

We offer comprehensive operation support across KYC, AML and trade surveillance process lifecycle.

Request for services

Find out more about how we can help your organization navigate its next. Let us know your areas of interest so that we can serve you better